In recent years, the landscape of online video consumption has undergone a significant shift, catalyzed further by the onset of the COVID-19 pandemic. The rise of global video content consumption was accentuated by Brightcove’s Q2 2020 Global Video Index, which reported an unprecedented 30% surge in viewership during the first half of 2020 compared to the preceding year. However, this surge in viewership wasn’t merely numerical; it reflected a fundamental evolution in audience preferences and behaviors.

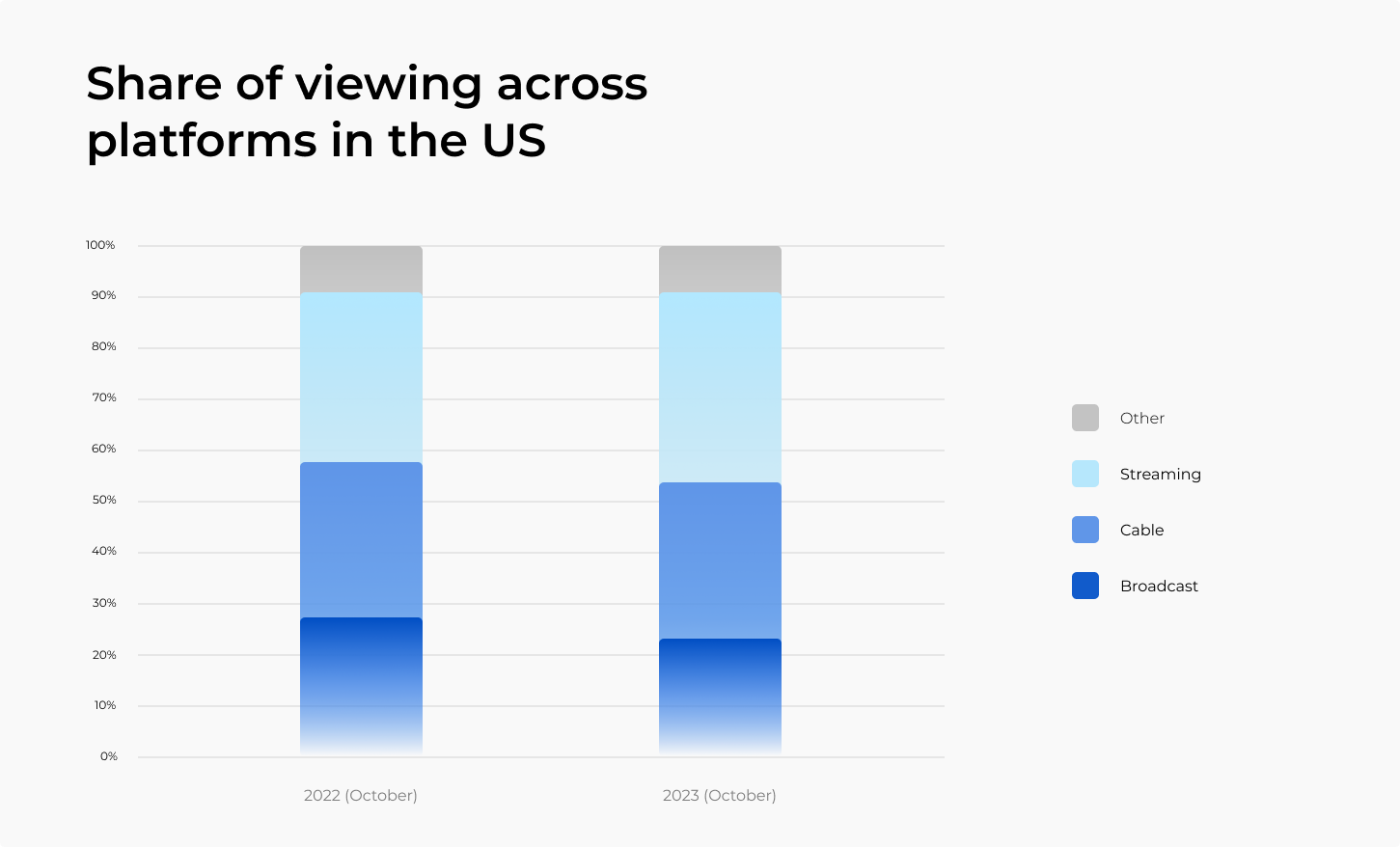

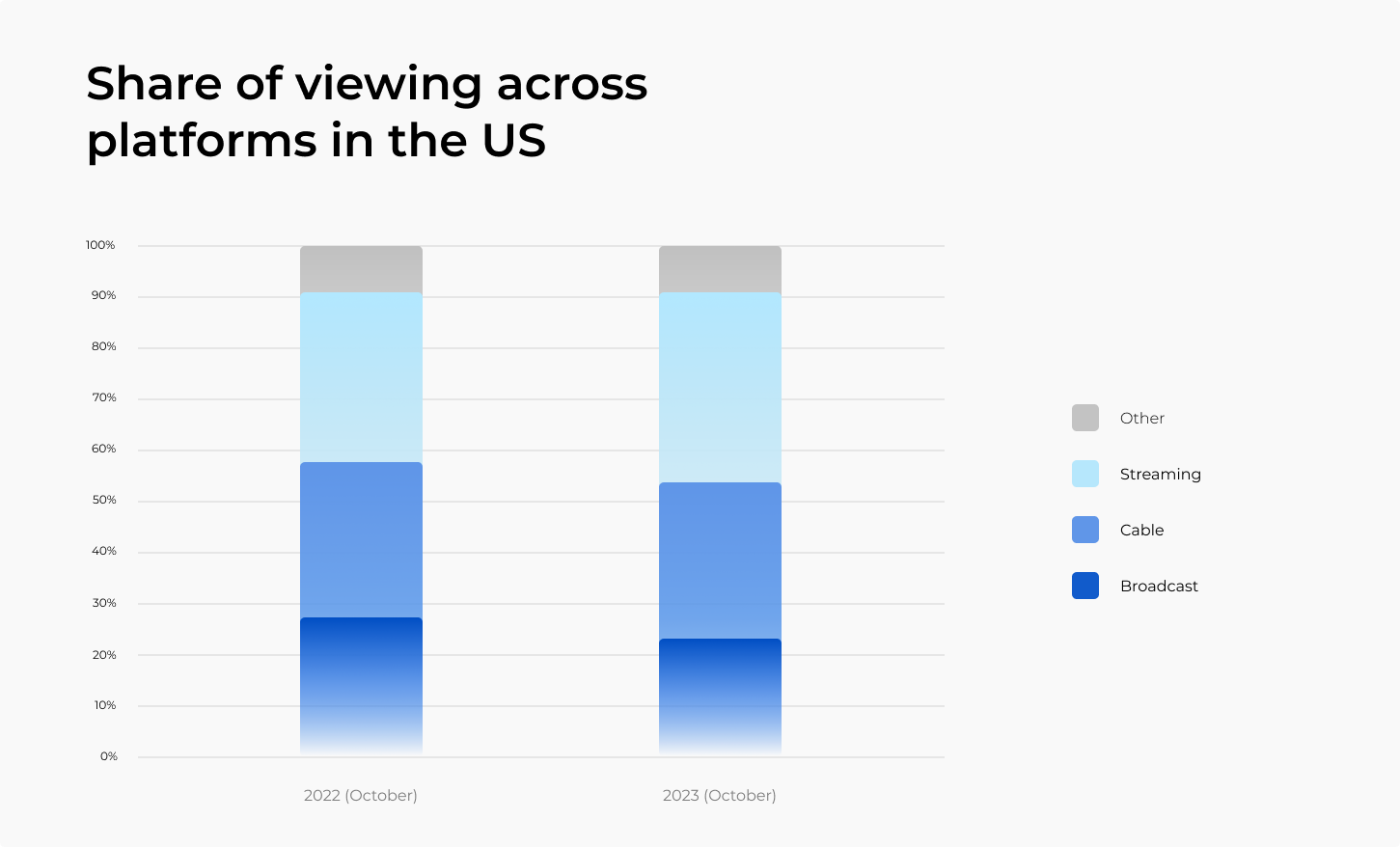

Notably, there emerged a trend towards premium content consumption, signifying a shift in consumer expectations and demands. Statista’s report also revealed a staggering 23% increase in the average time spent on subscription-based OTT (over-the-top) video-on-demand content in the United States alone. Moreover, the trajectory of OTT video services depicts a compelling narrative of growth and expansion. Projections indicate a global OTT video viewership base set to soar to 862.8 million users between 2023 and 2028, underscoring the profound impact and potential of this burgeoning industry. By 2023, a noticeable trend had emerged among consumers towards being less willing to pay for streaming services, yet they continued migrating to such platforms over traditional TV.

Source: State of MediaTech, IABM

In navigating this competitive landscape, selecting an appropriate revenue generation model will mitigate customer churn and enhance video content profitability. Whether opting for subscription-based, ad-supported, transactional, or hybrid models, the choice should be informed. Let’s delve into the nuances of the existing OTT business models and explore the monetization approaches of the largest OTT service providers.

What’s an OTT business model? History flashbacks

Meet an expert

Alexey Zaberezhniy — Video Solutions System Analyst at Oxagile

“Video content monetization commenced long ago, even before the era of DVD rentals, where viewers paid for temporary access to physical media. However, the advent of OTT platforms revolutionized the paradigm, introducing a new period of on-demand content delivery. The emergence of transactional video on demand (TVOD) marked a pivotal moment, igniting the framework for a multifaceted monetization ecosystem. As technology progressed, subscription-based models gained prominence, offering consumers unlimited access to the vast libraries of content for a recurring fee.”

What are typical OTT business models?

As the digital age evolved, the methods through which OTT platforms generate revenue from their content have diversified significantly. Among the most prevalent models are advertising video on demand (AVOD), subscription video on demand (SVOD), and transactional video on demand (TVOD). These distinct approaches represent the evolution of monetization strategies in response to changing consumer behaviors and technological advancements.

AVOD (Advertising video on demand)

Ad-powered content monetization

Ad-based video on demand (AVOD) is an OTT business model that presupposes monetizing video through ads. AVOD businesses provide free content to users and get revenue by selling ads while streaming their videos. This might include video commercials, banners, or fully sponsored content.

AVOD has been growing in popularity in recent years — with Pluto TV, Tubi, Xumo, and YouTube (non-premium) being the most notable OTT players in this niche.

Expert when-to-choose vision

“In the realm of video content provision, the dynamics of subscriber base size deeply influence revenue strategies. Smaller OTT service providers may face challenges in balancing costs against revenue, especially when relying solely on advertising. Cheaper content may offer lower copyright expenses, making it more reasonable to rely on ad-generated income. Still, market leaders often opt for SVOD models, prioritizing stability in predicting profitability and sustained subscriber growth. Alternatively, AVOD can serve as a promotional tool, offering users a taste of content without registration. The key difference in this case lies in strategic monetization aligned with audience expansion goals.”

SVOD (Subscription video on demand)

Subscription-based advertising

Unlike AVOD, subscription video on demand is not free for users. To watch as much content as they want without annoying ad interruptions, viewers should pay a flat rate per month. According to Adobe’s CMO, subscription-based advertising is the most popular content consumption model, with Netflix, Apple TV+, HBO, and YouTube Premium being leaders in this type of content distribution.

The macro factors of 2023 and shifting consumer viewing habits have exerted significant influence on the industry, prompting streaming service providers to respond to financial pressures through various measures, such as implementing price increases. To manage customer churn, those primarily reliant on subscription revenues also adapted by adhering to a hybrid approach. This involved offering special subscription plans, priced lower than standard or premium ones, but accompanied by ads during video playback. The proliferation of such offerings has increased steadily since 2023.

Expert when-to-choose vision

“The SVOD model offers predictability in revenue, crucial for covering costs, unlike advertising that poses challenges in revenue forecasting due to fluctuating viewership. In a saturated market with numerous OTT providers, user behavior becomes challenging to forecast, making revenue projections even more challenging. Subscription-based services grant a level of comfort for providers, offering clarity in revenue generation based on subscriber numbers. However, success hinges on offering compelling content, an investment that can be substantial.”

How we can help you

Experts in video monetization, we’re here to enable solid revenue streams for your OTT platform. Contact us now to get a no-obligation estimate.

TVOD (Transactional video on demand)

Transaction-based business model

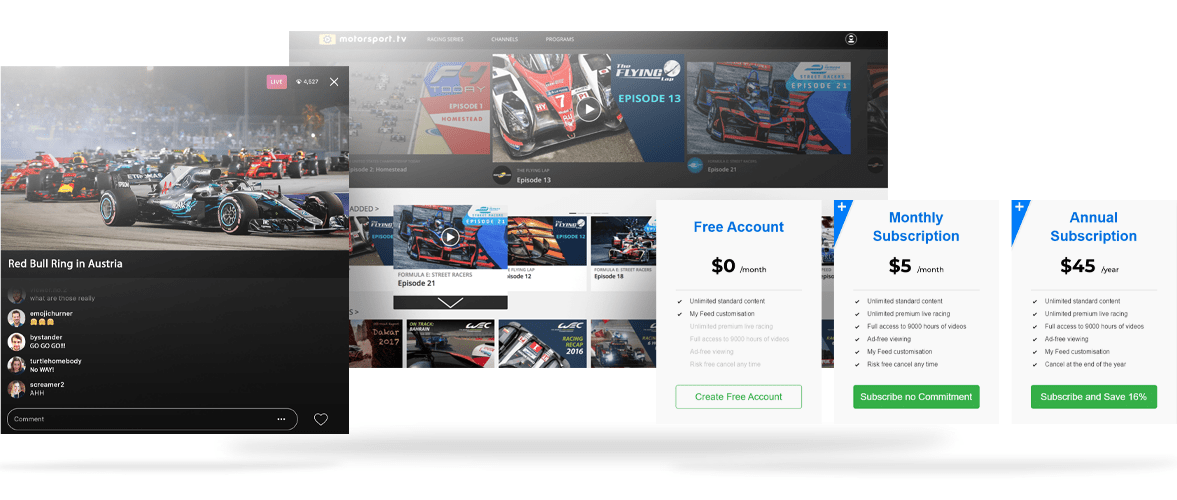

Also known as pay-per-view (PPV) or pay-per-download (PPD), transactional video on demand (TVOD) refers to buying or renting a piece of content for a set price. Before you decide to join the TVOD market along with services like iTunes, UFC, Sky Box Office, and CinemaNow, analyze the key advantages and disadvantages of this OTT monetization model.

Expert when-to-choose vision

“TVOD represents a distinct narrative in content consumption, rooted in the traditional concept of purchasing video views. Originating from live stream access to sports events, it evolved to encompass long-term rentals, such as movie viewing rights for a specified period. While tailored to niche audiences, TVOD lacks widespread appeal for large-scale sales. It may cater to specialized video viewers, like avid Star Wars enthusiasts purchasing entire series, yet remains limited in broader market traction.

Ideal for small businesses, the TVOD business model presupposes instant payments and, as a result, immediate income that can be used for further business development. However, there’s also a flip side: although immediate, this revenue stream may not be consistent enough.

But if your business revolves around the live broadcasting of music festivals, sports matches, or film debuts, TVOD may be the best way to deliver ad-free experiences for viewers.”

Hybrid OTT revenue models

If you want to enable more flexibility for your OTT platform, try a hybrid model. By providing a free, ad-supported, and premium subscription service, you can easily accommodate various viewer demands, while ensuring a reliable revenue stream.

For example, you can offer a wide library of lower-value content on an AVOD basis and monetize your premium video via subscriptions, while charging a higher price for particular content assets through a transaction-based model.

Besides, as part of your viewer engagement strategy, you can give free access to content — however, monetizing it with ads — before they sign up on a pay-per-view or subscription basis.

Expert when-to-choose vision

“There’s another example of the evolution in OTT monetization — the concept of a la carte pay television. However, diverse audience segmentation may pose challenges, making it difficult to achieve profitability when implementing it as is. While users may prefer customization, the pricing dynamics often result in minimal profits for content providers as viewers may choose a limited number of content assets, leading to less predictable profitability. The introduction of mixed packages, combining basic subscriptions with additional channels, offers a more viable solution. Moreover, the industry is witnessing a trend towards supplementary sources, as evidenced by Netflix introducing ad-supported plans alongside its SVOD services, reflecting evolving consumer preferences and revenue strategies.”

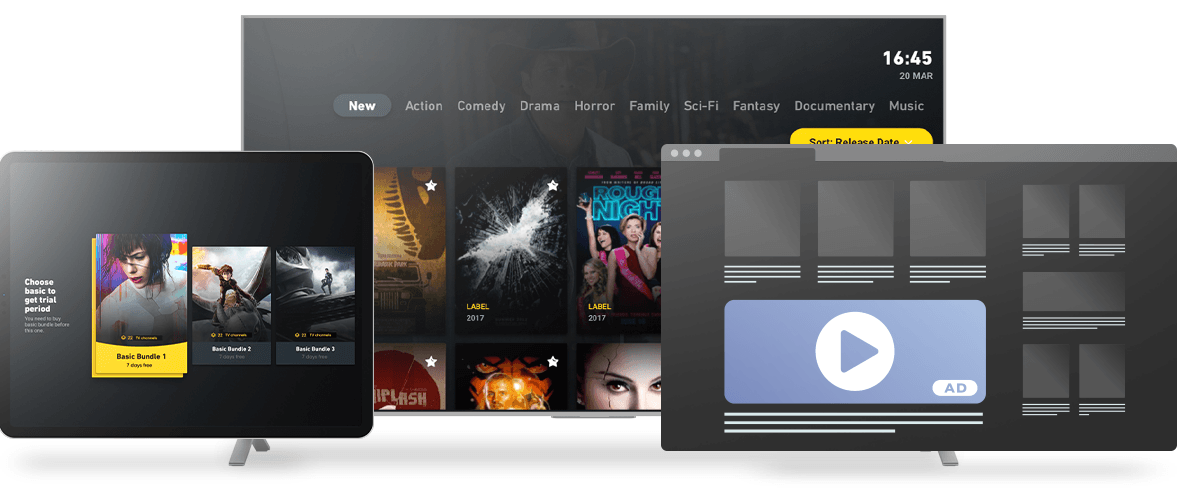

Case in point: Our VoD platform drove the client’s on-demand entertainment strategy

Oxagile’s team played a pivotal role in overhauling the web-based VoD service for the telecom operator. Thanks to our expertise, the client now boasts a VoD platform equipped with an array of sophisticated functionalities:

- Robust content and media management capabilities

- A tailored advertising module

- Enhanced video recommendation functionality

- Advanced search features

- Social components including ratings, comments, and seamless integration with social platforms

- Intuitive tag cloud navigation

Eager to delve deeper into the project? Click below for more insights.

Since 2023, media companies have been progressively blending content and delivery formats to offer a more engaging proposition to viewers. For example, there has been a notable surge in the quantity of FAST (Free Ad-Supported Television) channels, surpassing 1,500 in the US alone. Media enterprises also invest heavily in sports. This is exemplified by Netflix’s entry into the market, alongside collaborative efforts from industry giants like Disney, Warner Bros. Discovery, and Fox, who have jointly launched a sports streaming service along with their film and TV shows content specialization.

How OTT market leaders earn money: Overview and perspectives for 2024

Netflix

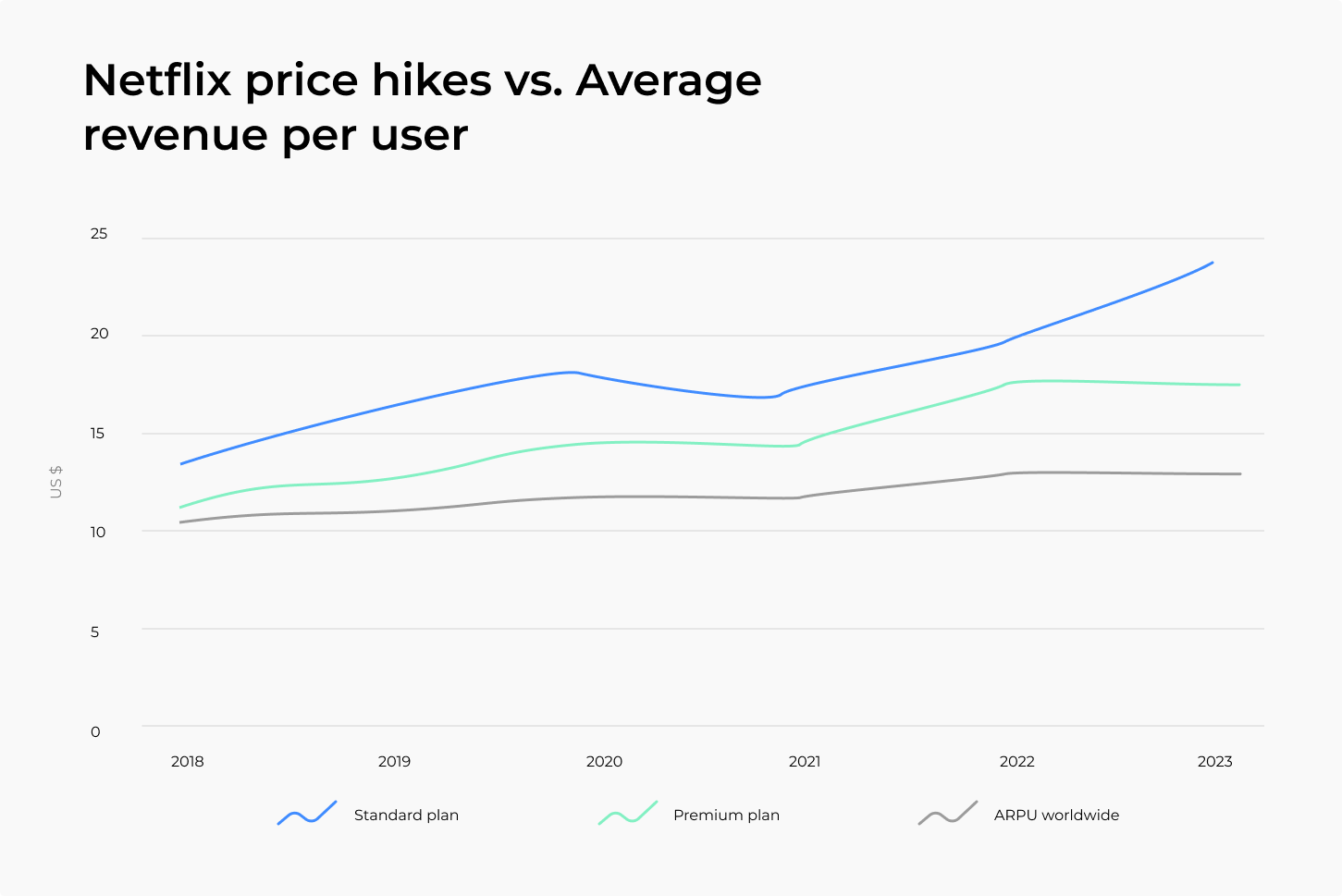

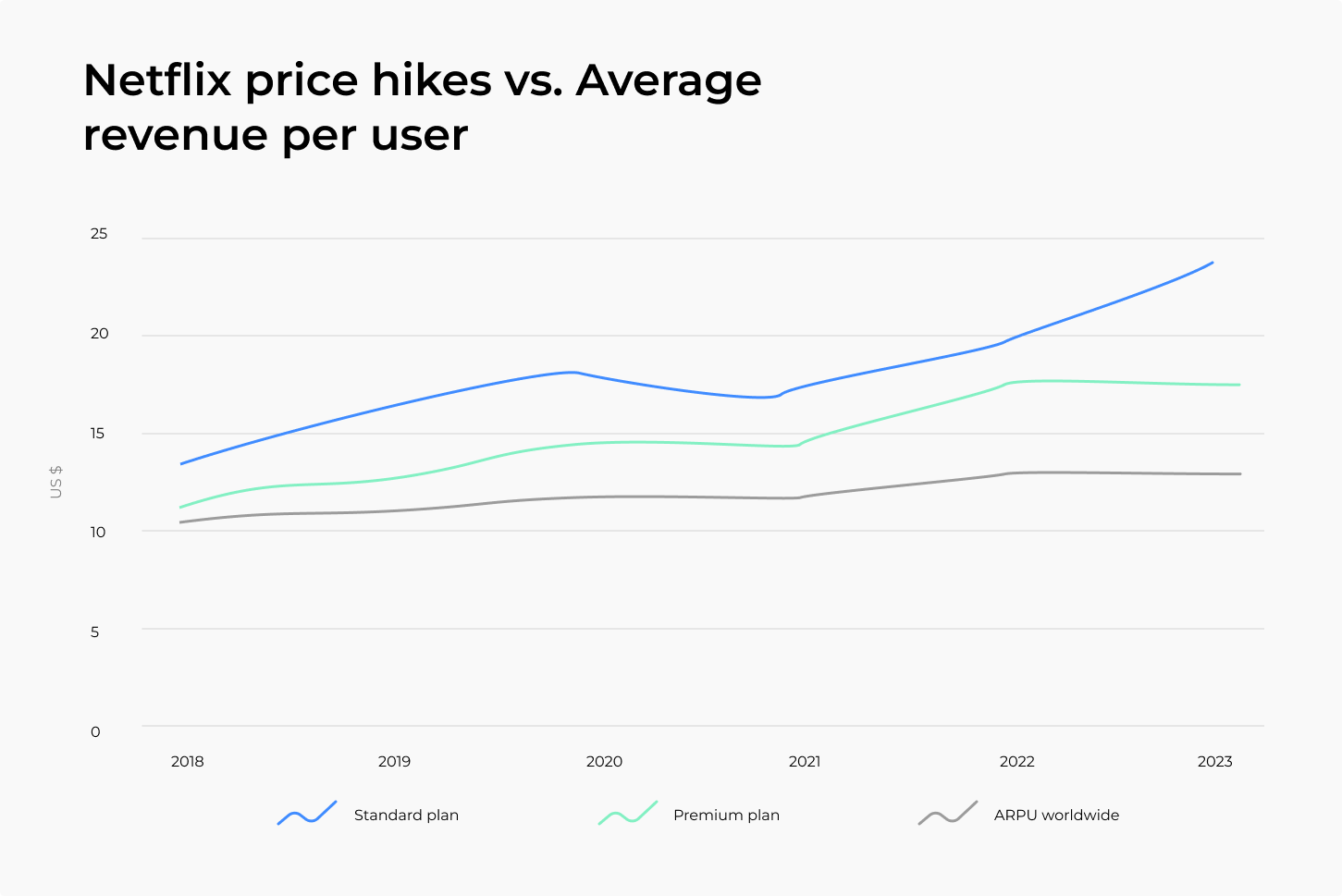

At the forefront of video content monetization, Netflix employs a dynamic subscription video-on-demand (SVOD) model, offering a trio of plans tailored to diverse viewer preferences: Basic, Standard, and Premium. These plans, distinguished by device support, streaming quality, and offline viewing capabilities, cater to the nuanced needs of subscribers worldwide. In a strategic move to expand accessibility, Netflix unveiled an ad-supported plan in selected regions like the US and UK, democratizing content consumption with a cost-effective alternative.

Like other SVOD streaming providers, Netflix has felt economic fluctuations, leading to price increases. However, in their efforts to sustain subscriber growth, they have also implemented other strategic initiatives. Demonstrating a commitment to service accessibility and mitigating user churn, Netflix introduced an ad-supported plan in select regions such as the US and UK, providing a cost-effective alternative and democratizing content consumption.

Source: State of MediaTech, IABM

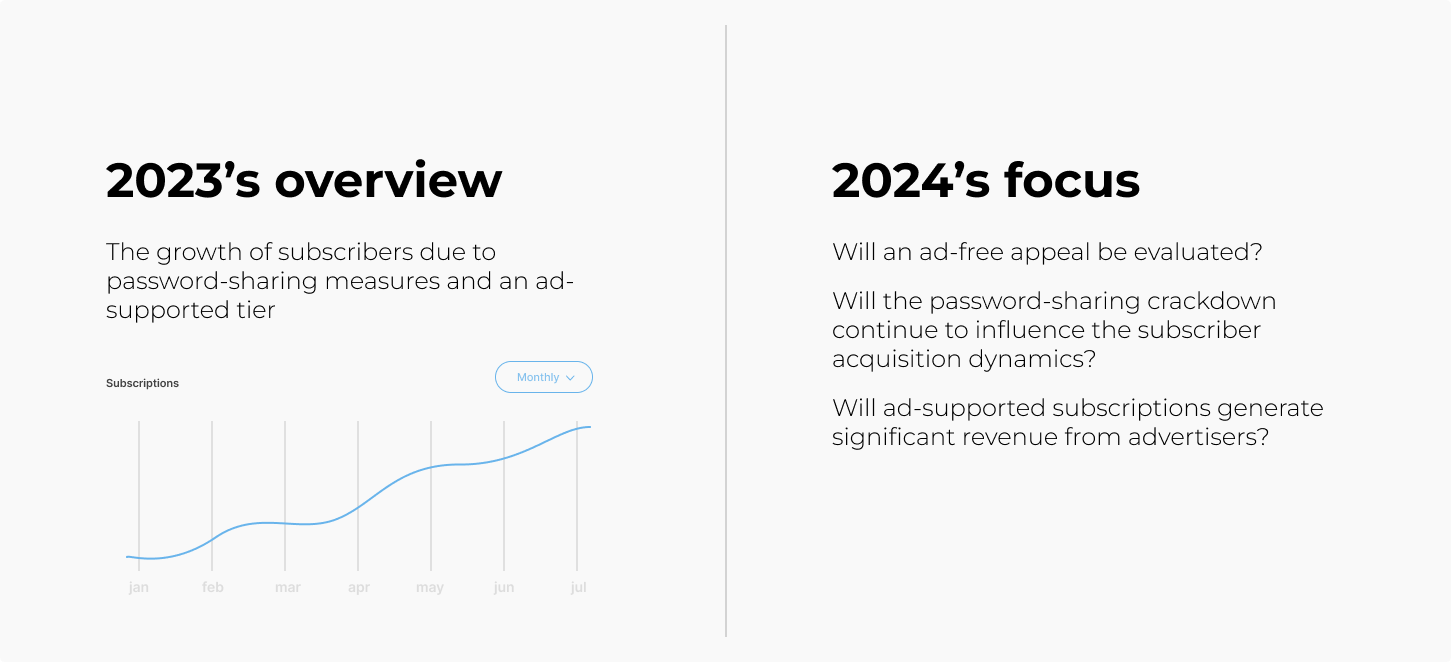

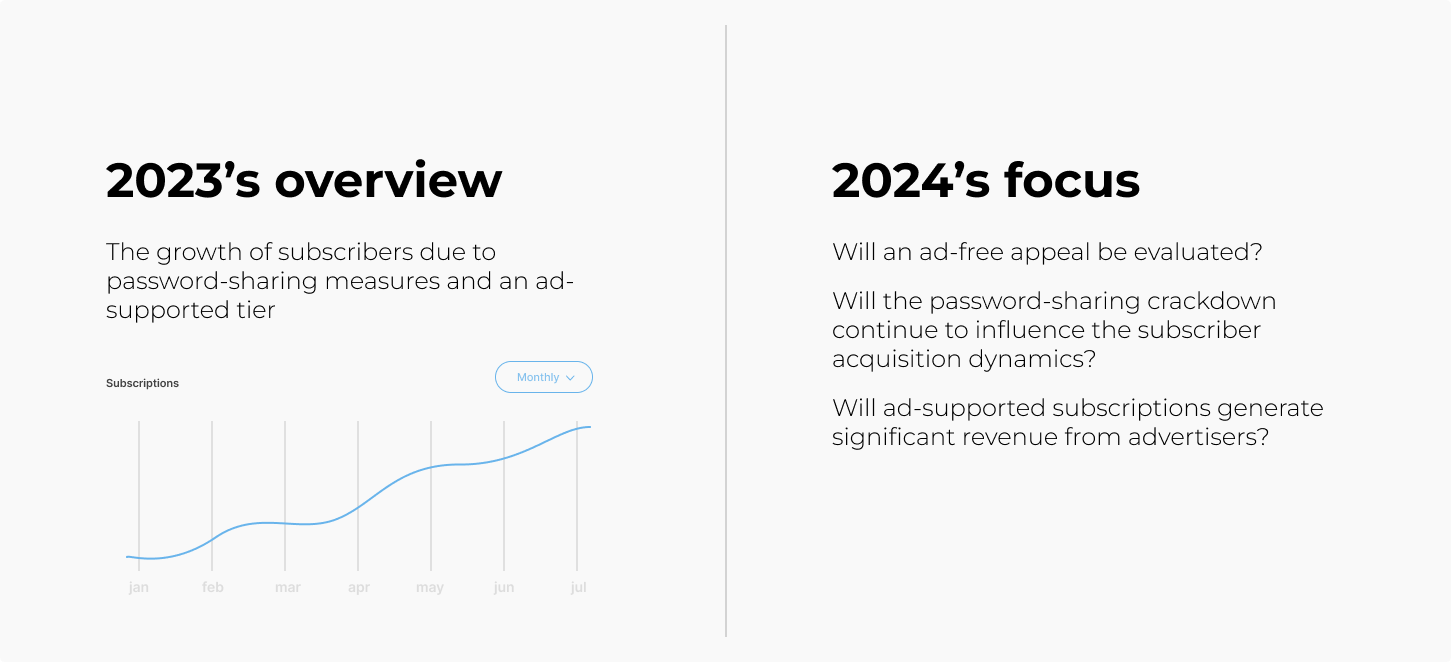

What are 2023’s results and new perspectives for Netflix?

In 2023, Netflix witnessed a surge in subscriber acquisition, propelled by stringent measures against password sharing and the rollout of the ad-supported tier. Leveraging these initiatives, coupled with strategic pricing adjustments for its US consumer base, Netflix experienced a remarkable increase in both revenue and subscriber base.

Industry observers are keenly attuned to pivotal developments shaping Netflix’s trajectory in 2024 in the way below:

- Ad-free subscriptions are of significant interest, with analysts examining whether subscriber growth dynamics will surge once more.

- Ad-supported subscriptions and their potential to generate more revenue than traditional ad-free subscriptions are under scrutiny.

- Netflix’s ongoing crackdown on password sharing remains a focal point, with stakeholders eager to ascertain its efficacy and the enduring impact on subscriber acquisition dynamics.

2023’s overview and perspectives for Netflix

YouTube

At the core of YouTube’s revenue model, there’s its robust advertising infrastructure. Given its reliance on third-party content to drive ad revenues, the platform has implemented stringent criteria for creators seeking monetization opportunities through ads, aiming to prioritize trusted creators producing original content. To foster deeper engagement between creators and their fan bases, YouTube has introduced a suite of additional monetization tools, including Super Chat, channel memberships, merchandise sales, and YouTube BrandConnect partnerships. Notably, YouTube operates on a revenue-sharing model, wherein creators receive a portion of the advertising revenue generated from their content.

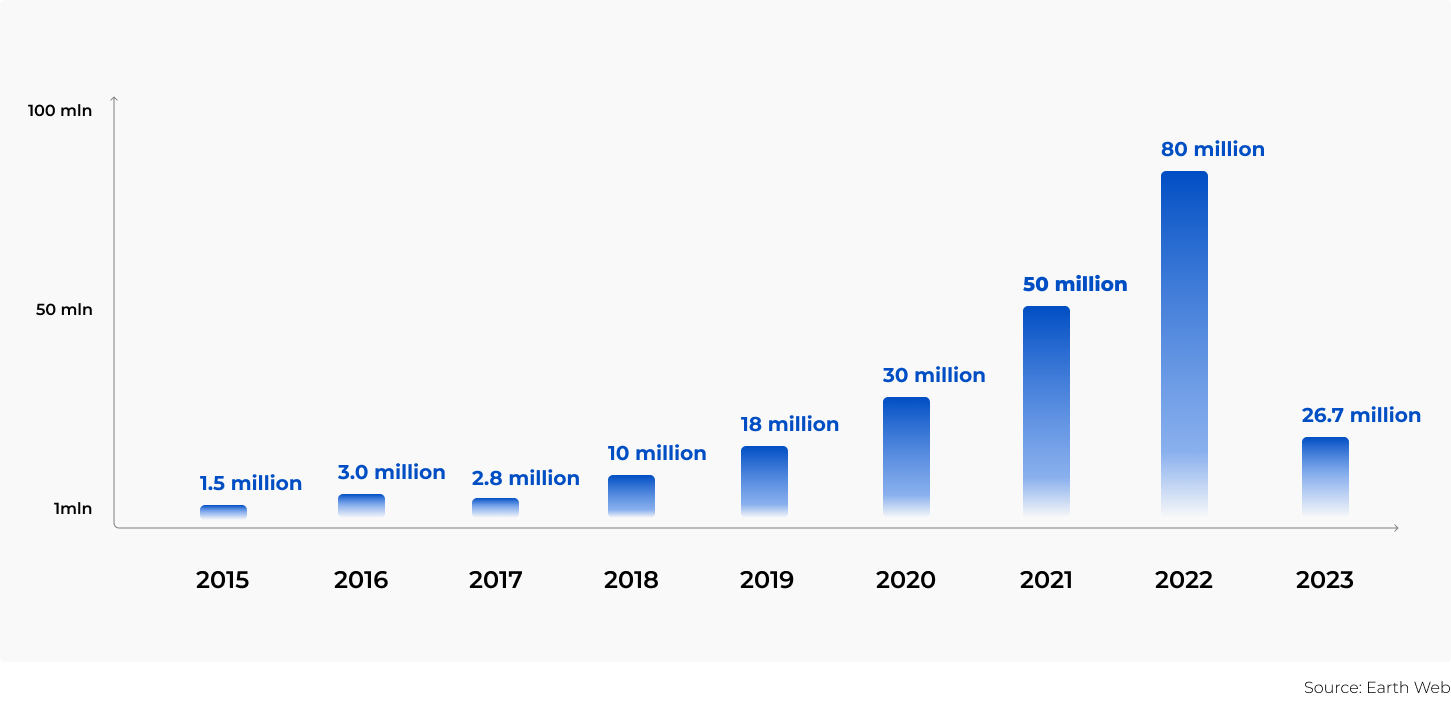

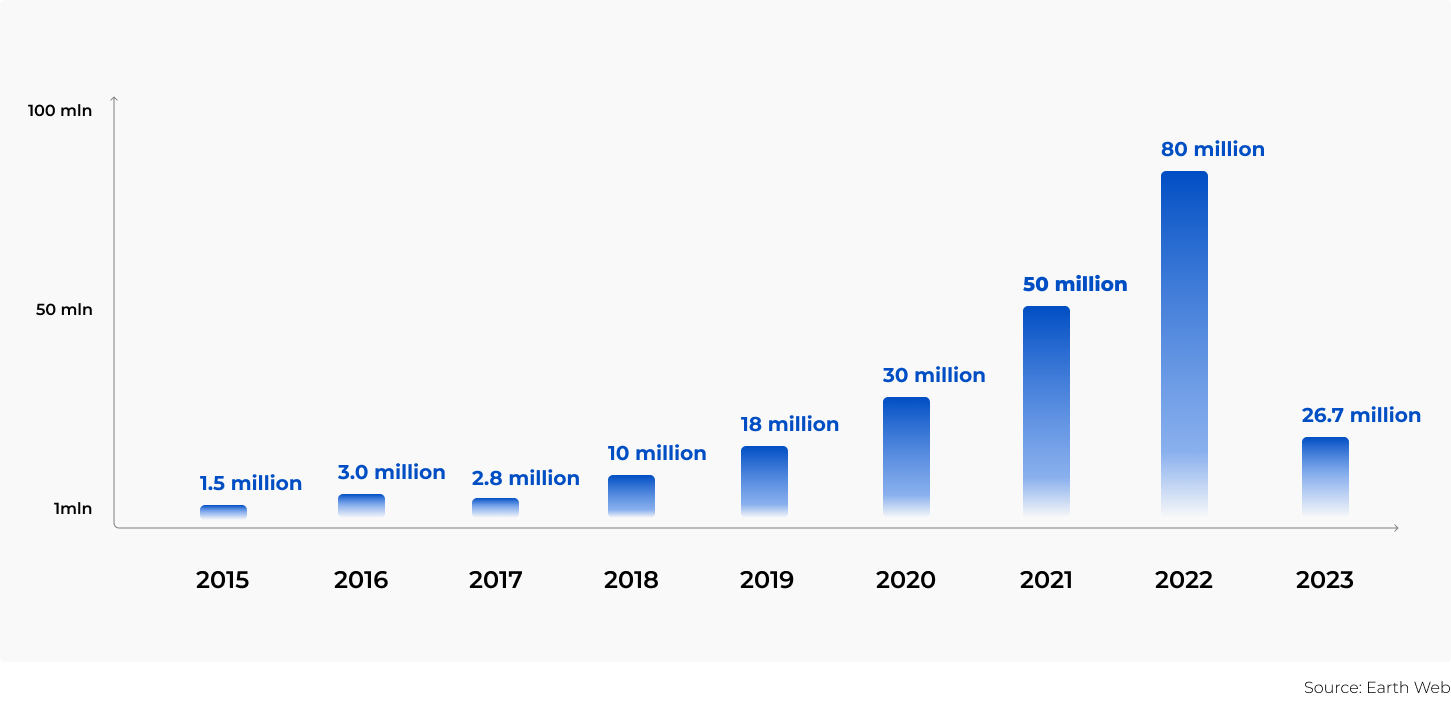

In a strategic shift reflective of evolving market dynamics, the platform diversified its offerings in 2015 with the introduction of YouTube Premium, catering to viewers seeking an ad-free experience. With approximately 26.7 million users embracing this premium service by 2023, YouTube’s trajectory underscores its adaptability to changing consumer preferences. Forecasts indicate a robust revenue growth projection of 10.3% in 2024, propelling the platform’s earnings to an estimated $33.5 billion by year-end. This evolution epitomizes YouTube’s commitment to innovation and its enduring influence on the digital landscape.

YouTube premium subscribers by year

Concluding: How to choose a perfect revenue model

Analyzing the experience of industry leaders offers valuable insights into navigating the dynamic landscape of OTT platforms. By understanding market conditions, including emerging trends and competitive dynamics, businesses can position themselves strategically for growth. Moreover, leveraging subscriber data and feedback enables personalized content delivery, enhancing user satisfaction and retention. Ultimately, the key to success lies in continually refining content offerings and optimizing the platform user experience to meet evolving consumer expectations in an increasingly competitive market. By staying attuned to these factors, OTT providers can cultivate loyal audiences and thrive in the digital streaming ecosystem.

Get advice from online video professionals

Let us dive deeper into your streaming services and help you build an effective hybrid monetization strategy.

Recapping frequently asked questions

How to monetize OTT streaming services?

To monetize OTT streaming services, there are several established revenue models available. You can opt for subscription video on demand (SVOD), where users pay a recurring fee for unlimited access to content, or ad-supported video on demand (AVOD), which generates revenue through advertisements shown during playback. Additionally, there’s transactional video on demand (TVOD), where users pay per view or per rental. Alternatively, you can create a hybrid model that combines elements from these platforms to suit your specific audience and content offerings, maximizing monetization potential.

How to choose an appropriate OTT business model?

Choosing an OTT business model is not as easy as it seems. Before you decide what way to monetize your videos, you need to analyze the crowded OTT marketplace and identify viewers’ needs. With this information in mind, it will be easier for you to build and scale your offering. As experts in OTT app development, integration, and customization, we can help you satisfy target users’ interests and enter the market with a relevant value proposition.