The concept of Business Intelligence and why it matters

Everyone, from managers to chief executives, loves figures. Especially figures showing highs and lows in financial performance adorned in a visually appealing wrapping.

And this is exactly what Business Intelligence tools do. They collect information from multiple sources, process and analyze it, and “marry” it to a pretty exterior that makes sense for anyone who looks at it. They become interpreters, translating overwhelming volumes of financial data that only experts handling such data daily can understand into actionable graphics and tables that any executive can grasp.

However, practical evidence suggests that often the BI technologies that businesses invest in contribute to confusion and bad decisions, rather than “light bulb” moments. Why does this happen, and on the flip side, what gives some businesses the edge to make the most out of BI?

Our expert, Oxagile’s Chief Financial Officer (CFO) Olga Akulich, unravels this mystery, while also sharing her firsthand experience regarding:

- The factors that contribute to successful BI implementation

- The role of the contemporary CFO in the BI paradigm and their area of responsibility for ensuring a smooth process

- The intricacies of BI mechanics in the financial context

- The stumbling blocks that may arise during BI implementation and the best practices to resolve them

Meet an expert

Olga Akulich — Oxagile’s Chief Financial Officer, with a strong background of over 15 years in finance, including a two-year experience as a leading consultant for an international BI tools integrator, and a proven track record of effectively implementing IFRS standards, optimizing financial processes, and streamlining numbers-based decision-making for international holdings and leading local companies, including a company with EBRD investments.

Formula for BI success in Finance

Let’s get some fundamentals out of the way first and specify a crucial idea that will run as a red thread throughout this article: the key to success with BI doesn’t lie in the tool chosen to address business challenges. It rather depends on understanding the business issue itself, recognizing the importance of BI systems as a solution, and, above all, corporate management maturity, which is manifested in:

- A business team interested in BI implementation

- A process of gradual BI system implementation, which covers different tasks, rather than the chaotic deployment of an autonomous tool in case of rapid business growth

- A driver and coordinator of the whole process (usually a CFO)

Expert perspective:

“The goal of implementing BI lies in the appearance of a unified language between functions: finance and business are on the same page from the very start. For instance, finance can observe an increase in non-liquid goods, while the business, within the same interface, can see if gross income is decreasing and identify which clients and projects are affected.

However, for this entire cross-functional system to work, a significant responsibility falls on the shoulders of the Head of Finance.”

CFO’s responsibilities in orchestrating BI implementation

The CFO’s primary objective is to create and implement a system that facilitates data-driven decision-making within the organization.

Such fostering of a data-driven culture may include setting processes for all employees, embracing data-driven practices, and restructuring some aspects of the company’s operations to ensure seamless data integration and further accessibility across different departments and teams.

The CFO’s areas of responsibility also include:

Reaching a consensus with shareholders or owners on how the company’s strategy is going to be manifested in figures

Establishing well-coordinated work of all company departments in order to achieve these figures

Researching whether the necessary data exists in the information systems and formulating the requirements so that Business Intelligence tools aggregate and collect the needed data

Controlling the dashboards deployment

Beware of the traps: potential pitfalls in using BI

Implementing a BI system in a company is like ascending a mountain, where the CFO plays the role of the chief alpinist, driving and guiding the process, taking steps to ensure everyone stays on track at various checkpoints, and gradually anchoring the entire team at specific milestones, ensuring that no one slips and falls down.

But at each stage of the journey up the “BI mountain”, there are still lots of different obstacles that need to be managed effectively.

And before we get lost in these metaphors, let’s give the mic to Olga (our “chief alpinist”), who has hands-on experience in dealing with the possible hurdles while implementing BI systems, along with proven ways to overcome them and help you climb to new heights.

Expert perspective:

“Essentially, the main failure in BI implementation is doing it without any effect. Money is spent, the BI system is seemingly integrated into processes and other solutions, but nothing works as intended. As a result, instead of ascending Everest, it’s more like wandering around the mountain.”

The roots of this issue may stem from an interplay of the factors like:

- Poor data quality

If the company doesn’t handle its data properly from the start, as described in this data quality guide, trying to incorporate business intelligence is unlikely to bring successful results.

- Employees’ reluctance to change

Resistance to switch to new processes may arise from a lack of skills and appropriate training, or from a simple unwillingness to leave the comfort zone and adapt to new approaches.

- The only driver for BI implementation being the Chief Information Officer

While people in this position perfectly understand the technical side of the issue, they usually lack a deep understanding of business metrics, which makes it a better scenario to form a collaboration between the CIO and the CFO and start BI implementation as a wholesome process.

Conquering BI implementation: What it takes for BI to make, not break your business

“We want a robust BI system that accurately presents all the processes impacting the company’s financial state,” most employers say.

“We need everything at once, preferably yesterday and with minimum resources involved,” they also tend to say.

And while the desire to get accurate data and track KPIs immediately is understandable, rushing to plug in BI into existing processes will most likely lead to insights similar to fortune telling in terms of effectiveness and accuracy.

So here’s a carefully planned strategy from our expert to help you find the right starting point and make no mistake with the next steps of proper BI integration.

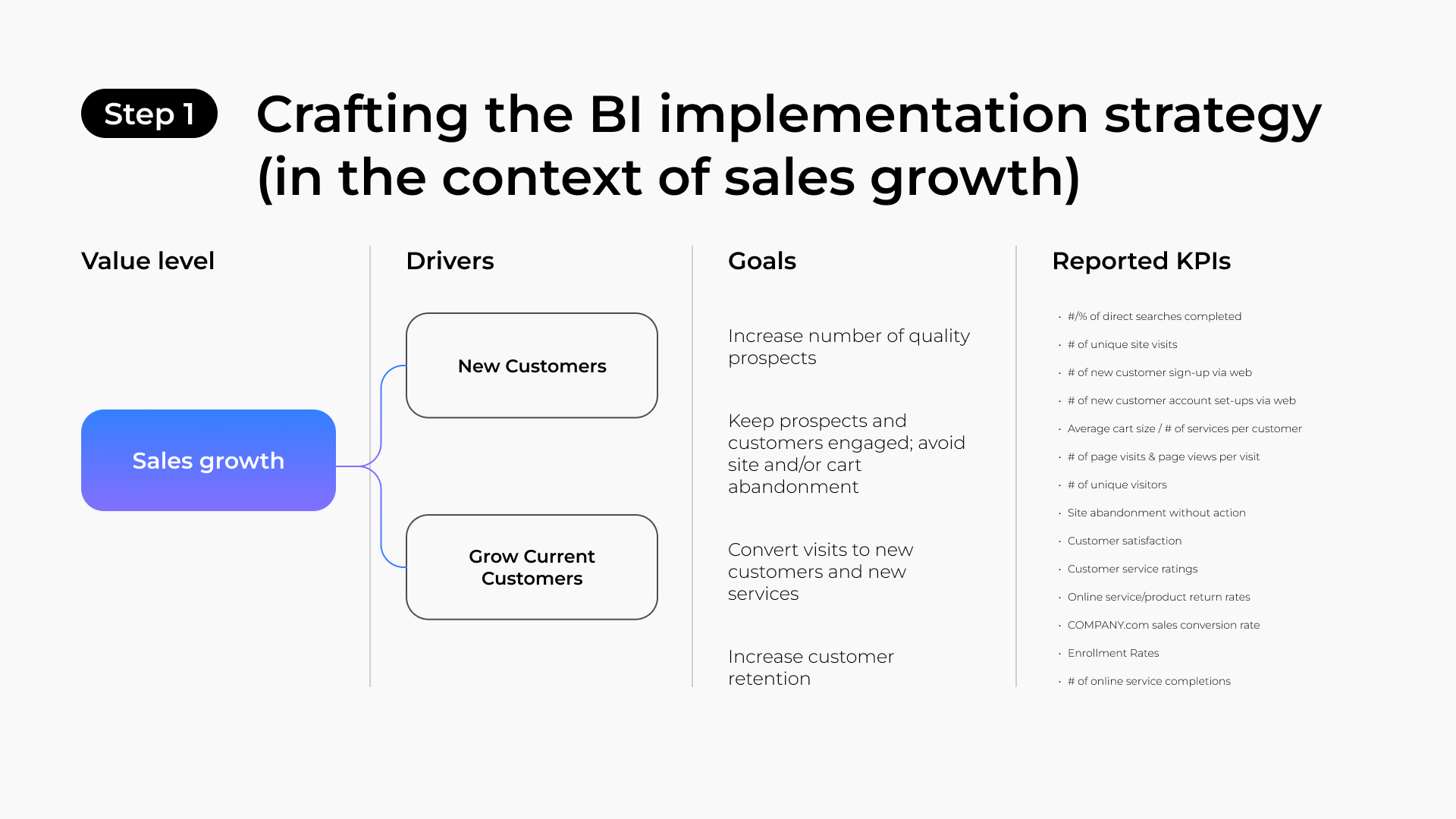

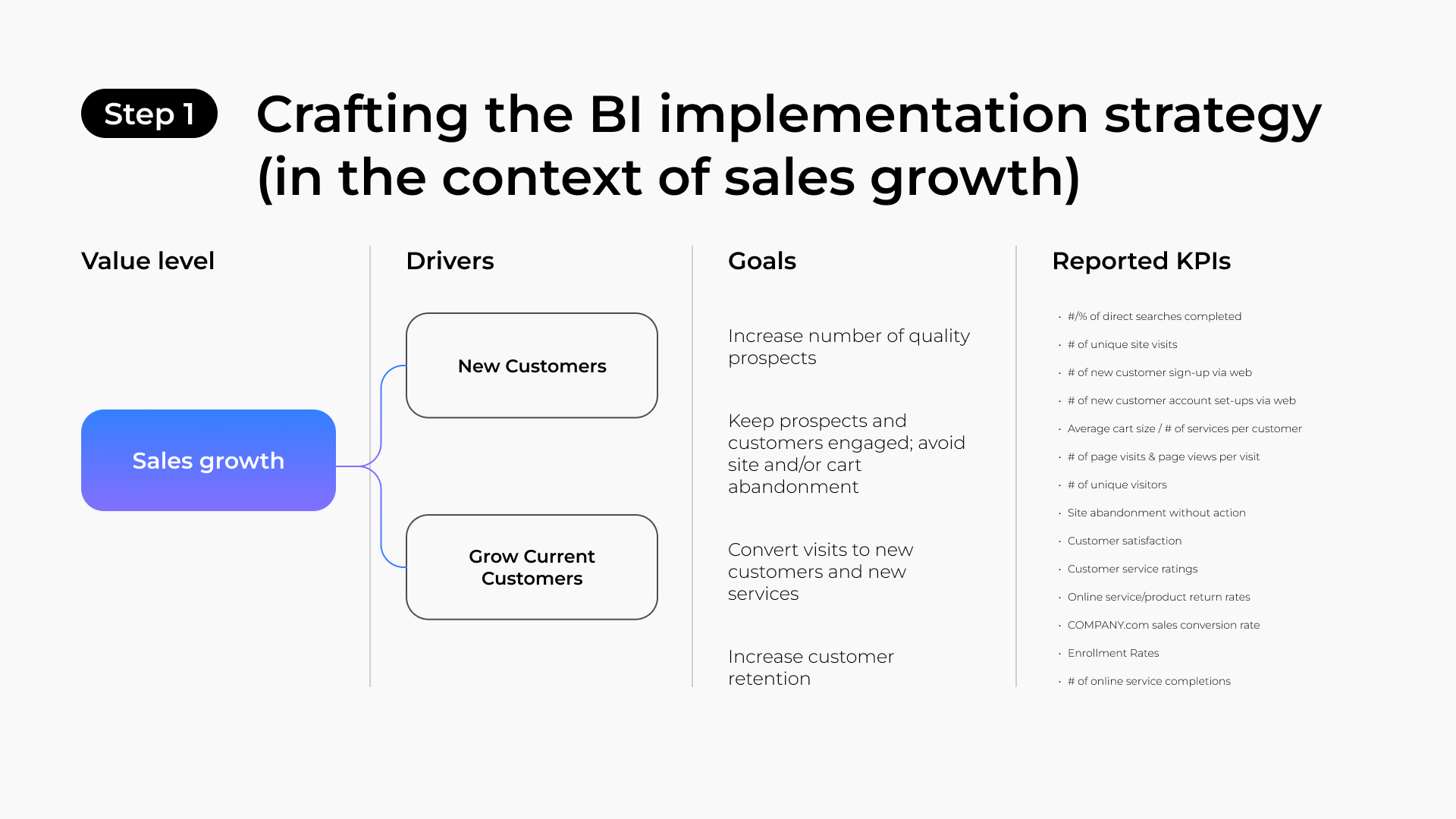

Step 1: Crafting the BI implementation strategy

This involves defining and analyzing long-term goals for each functional area.

Rather than getting overwhelmed by the vast array of available solutions, start with selecting a specific department’s use case to focus on addressing certain pain points (e.g., “reduce inventory”, “increase sales volume”, etc.).

Step 2. Data sources description and data availability analysis

Step 3. Working with reference data

There are two alternative approaches: one involves pre-cleaning and normalizing the reference data prior to its integration into the BI system, which is especially applicable when dealing with limited data and references.

The second approach implies importing raw data into the BI system and then collaborating with the development and analytics team to determine the priority of cleansing the reference data.

Step 4. Validation and approval of performance indicator methodologies

Step 5. BI solution implementation

Alongside all these steps, it is also crucial to focus on fostering a strong analytical culture and establishing analytical communities within the company.

Cheat codes to make climbing the BI mountain a ride on escalator

Circling back to our metaphorical universe, where implementing new processes can be like a climb to the mountain summit, we feel like noting that when some may opt for physical challenges and risky routes, others take alternative, hidden paths to reach the top quicker and safer. And here are our expert’s “hidden paths” leading straight up:

1. Give your business a “quick win”

It means finding the area where implementing BI will provide the maximum return on investment. Usually, it’s about handling aspects like inventory, analyzing missed sales opportunities, or studying customer behavior — areas where complex analytics and manual processing fall short or can’t solve the problem effectively.

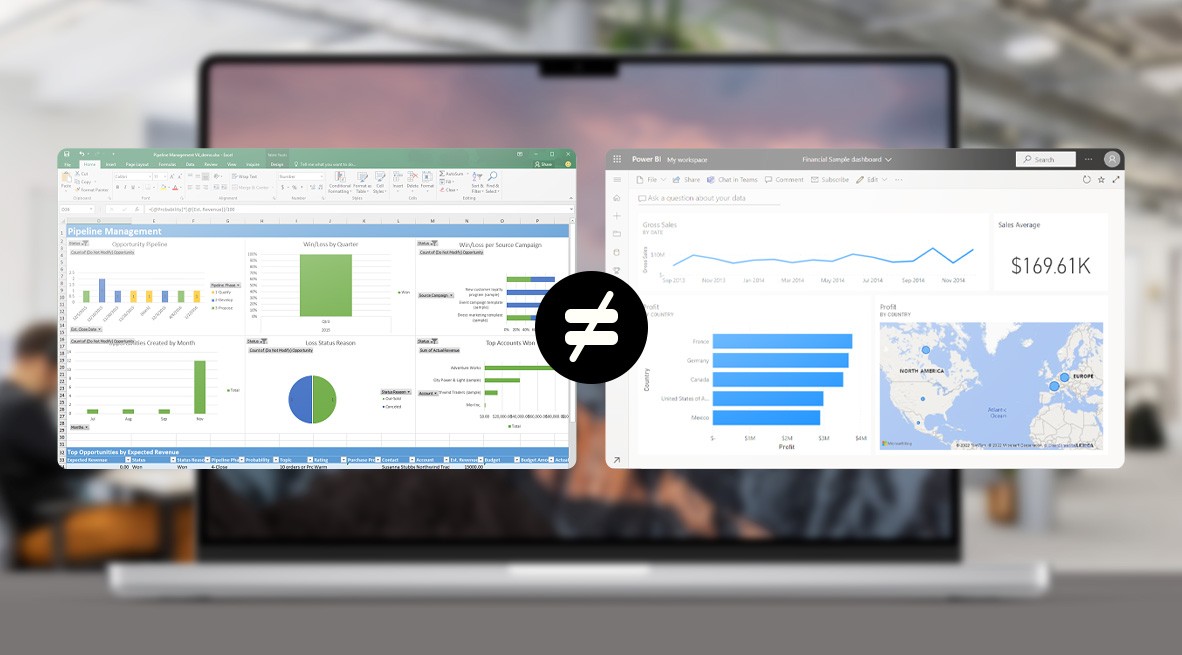

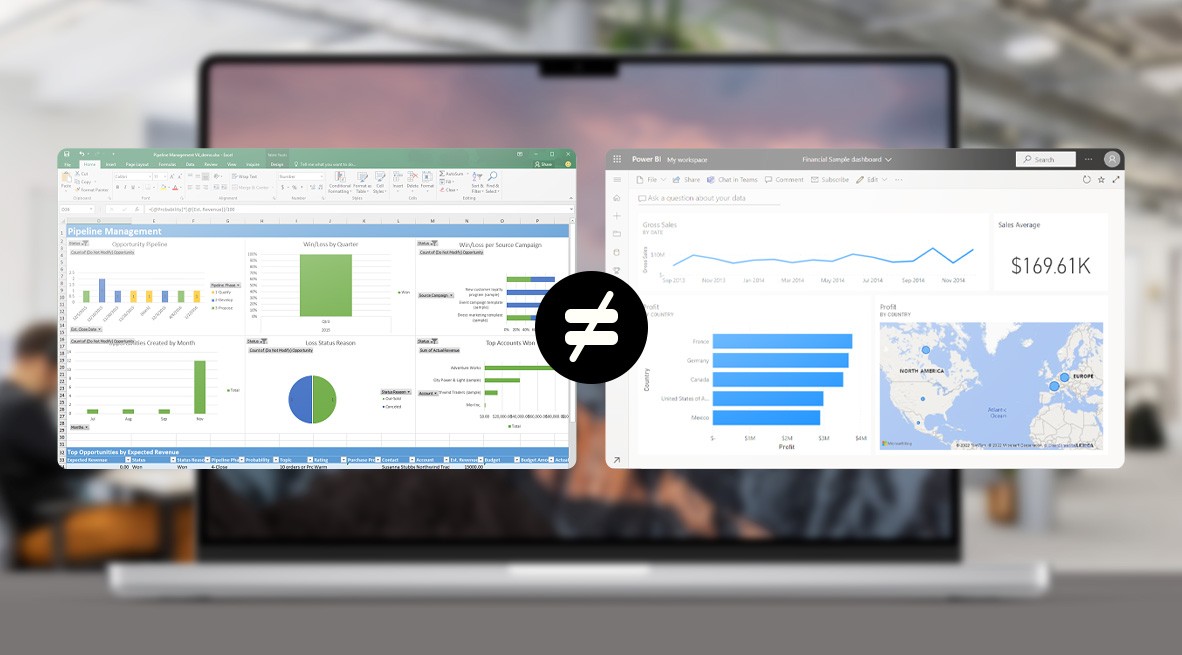

2. Don’t use BI as a mere Excel replicator

BI isn’t just about “seeing a table with customers”, but rather understanding “which major customers stopped buying this month.” So, a good BI system should focus on forming an analytical chain that quickly delivers valuable insights to business, not just replicating existing reports in a different interface.

3. Multifaceted approach to building the analytical culture

Changing the analytical culture is a vital step because simply providing employees with access to the BI application won’t bring about real change. They may resist using a new tool and might need to be taught how to analyze things differently.

Expert perspective:

“The instruments and processes I’d also recommend setting up are:

- Forming an analytical department or analytical community that will be engaged in this project full-time;

- Conducting regular in-company training courses and seminars where analysts show the business what the benefits of implementing a BI system are or will be;

- Including the use of the BI system in KPIs, if necessary.”

What makes the efforts and costs invested in BI by numerous companies worth it

Expert perspective:

“It’s fascinating how technologies, with their extensive variety and potential, can liberate the human mind from routine tasks. By freeing the brain from low-level work, we enable the capacity for more creative and high-quality decision-making.

For example, in the retail sphere, competent managers are particularly crucial. They must effectively determine what to purchase and control the products that are successfully sold and those that remain in stock. However, if these managers are constantly consumed by inventory and sales tracking, their ability to make smart decisions will significantly decrease.

This is where the BI comes into play. But it’s important to note here that we should consider BI not merely as tools like Looker or Power BI, but rather as systems and means for solving specific business tasks and optimizing a company’s operations.

In production, for instance, BI can be great for assessing the efficiency of production plan execution, the availability of human resources, and the management of component and raw material supply. In distribution, BI is an indispensable tool for supporting sales and operations planning (S&OP) processes. When it comes to companies involved in hardware or software development, BI can prove advantageous in analyzing various data related to projects, the efficiency of all processes, employee skills, and workloads.

Ultimately, the conscious utilization of BI systems enables businesses to become more flexible and successful, while allowing their employees to express themselves in a more creative and productive way.

So it’s a mutually beneficial interaction that can become a real catalyst for the company’s growth and development.”