As AdTech innovators, we’ve been following the market trends and trying to implement brand-new technologies and approaches to meet the needs of TV advertisers, publishers, software vendors, and FAST inventory aggregators.

While networking at OTT Sports Pro, where the sports broadcast market is explored annually, we’ve collected plenty of AdTech insights, and are pleased to share them with you, backed by Oxagile’s considerations.

Is the future in FAST services?

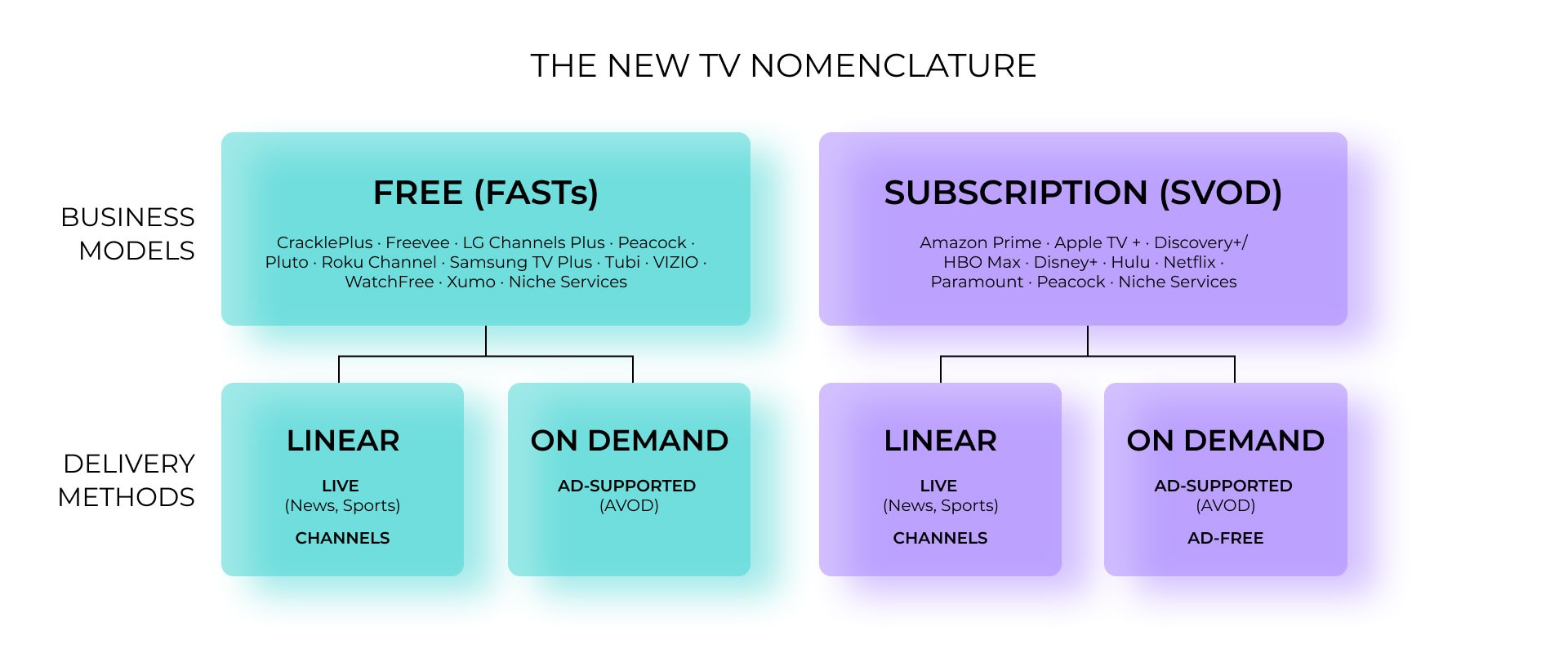

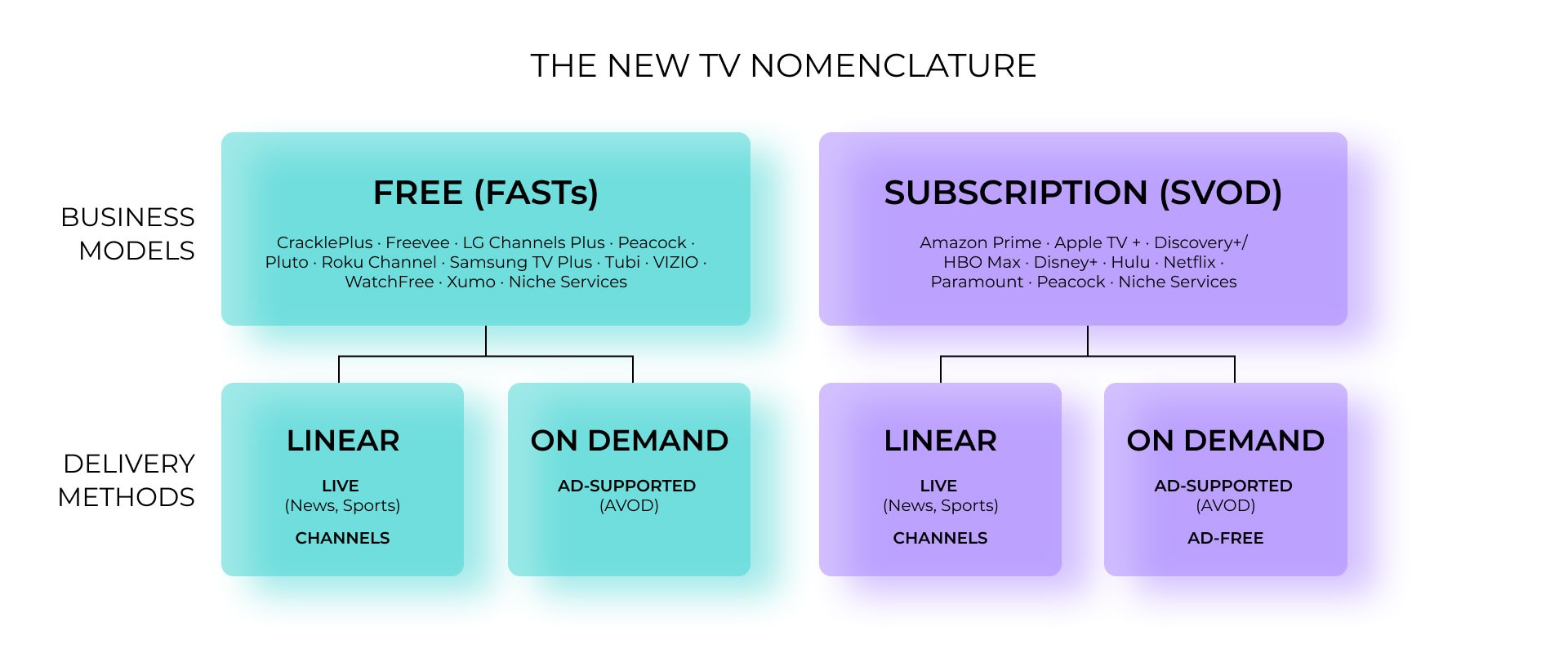

Before answering this question, let’s understand if we’re on the same page about what FAST is, because there are different terms related to FAST and SVOD, sometimes misused or used in similar contexts. In our article, we’re following the definition suggested by TVREV report’s authors. And the key difference is whether TV services are provided for free or based on the subscription. So, all TV services, be they linear or on-demand, are provided for free, and supported by ads, state for FAST services.

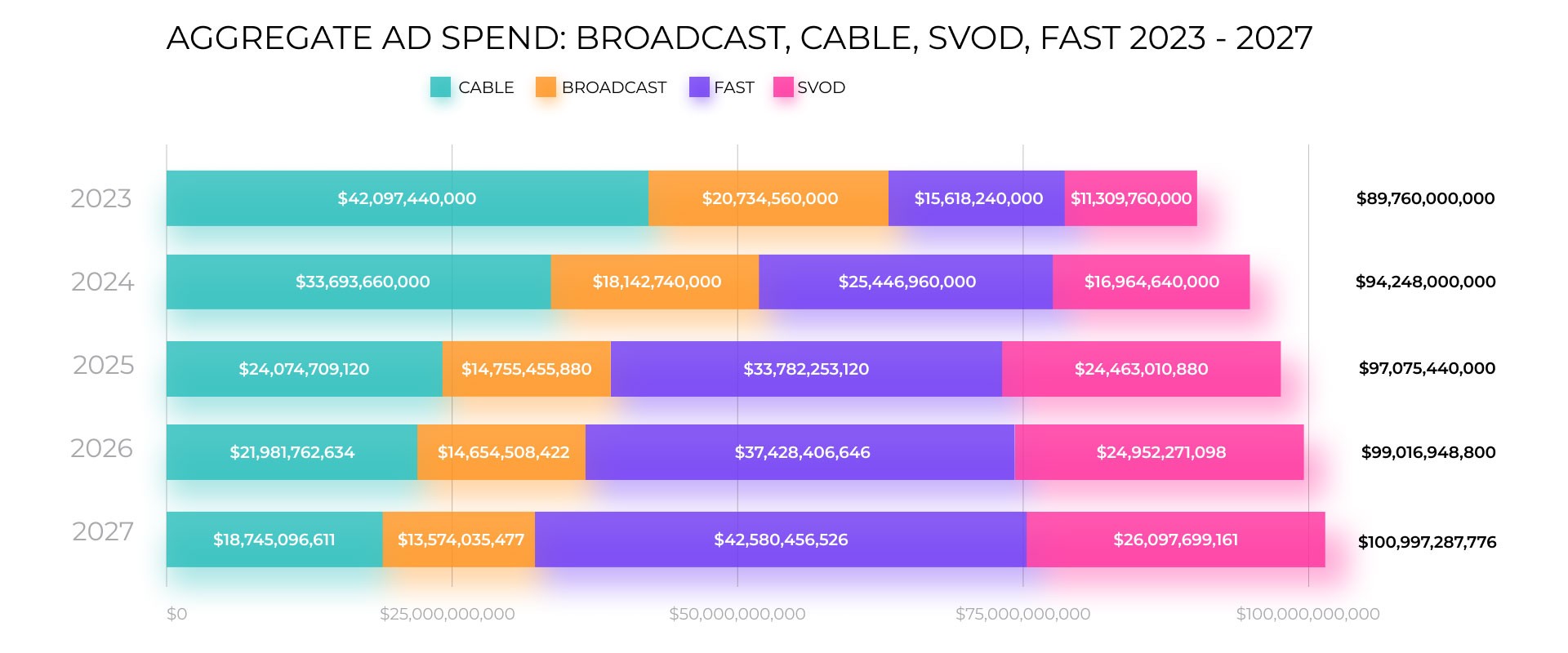

Source: TVREV report

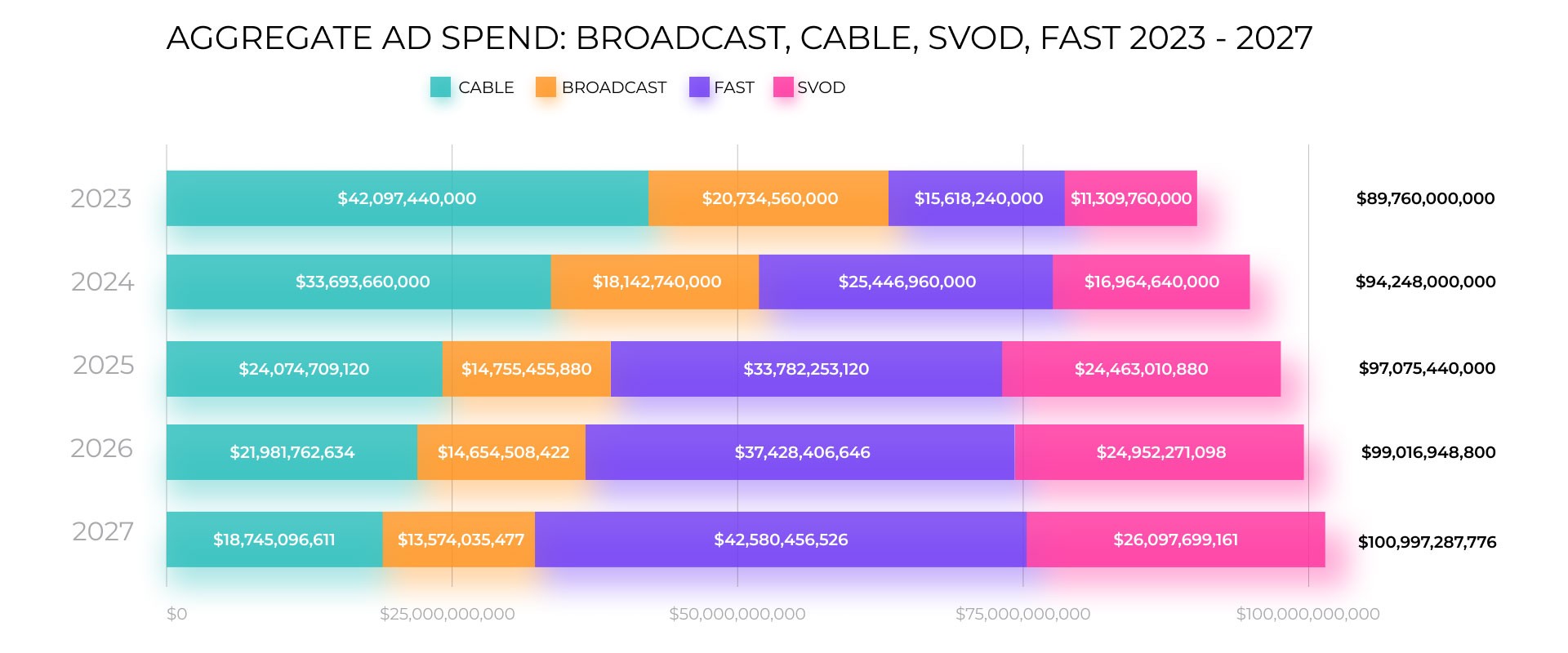

And now let’s get down to business. Is FAST certainly the thing of the future? TVREV report concludes that it’s likely to be “yes”. The figures say for themselves.

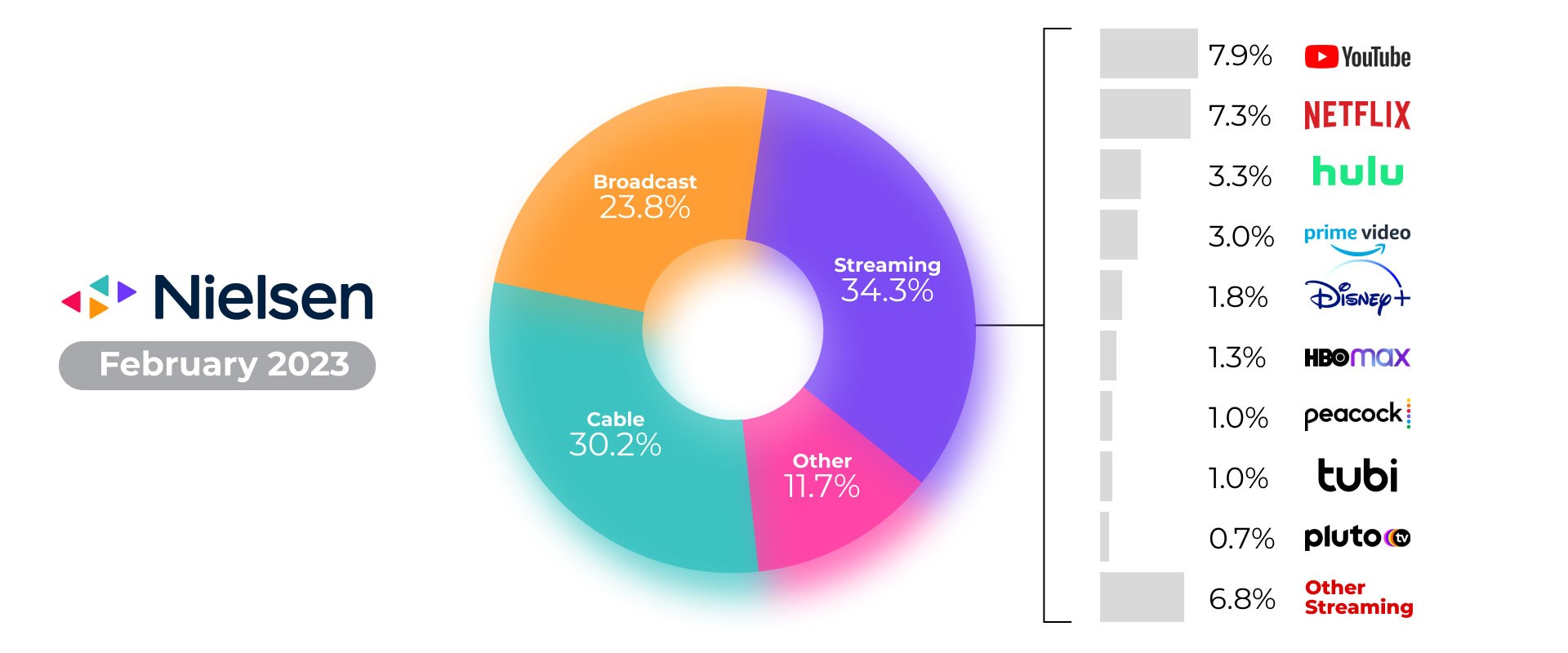

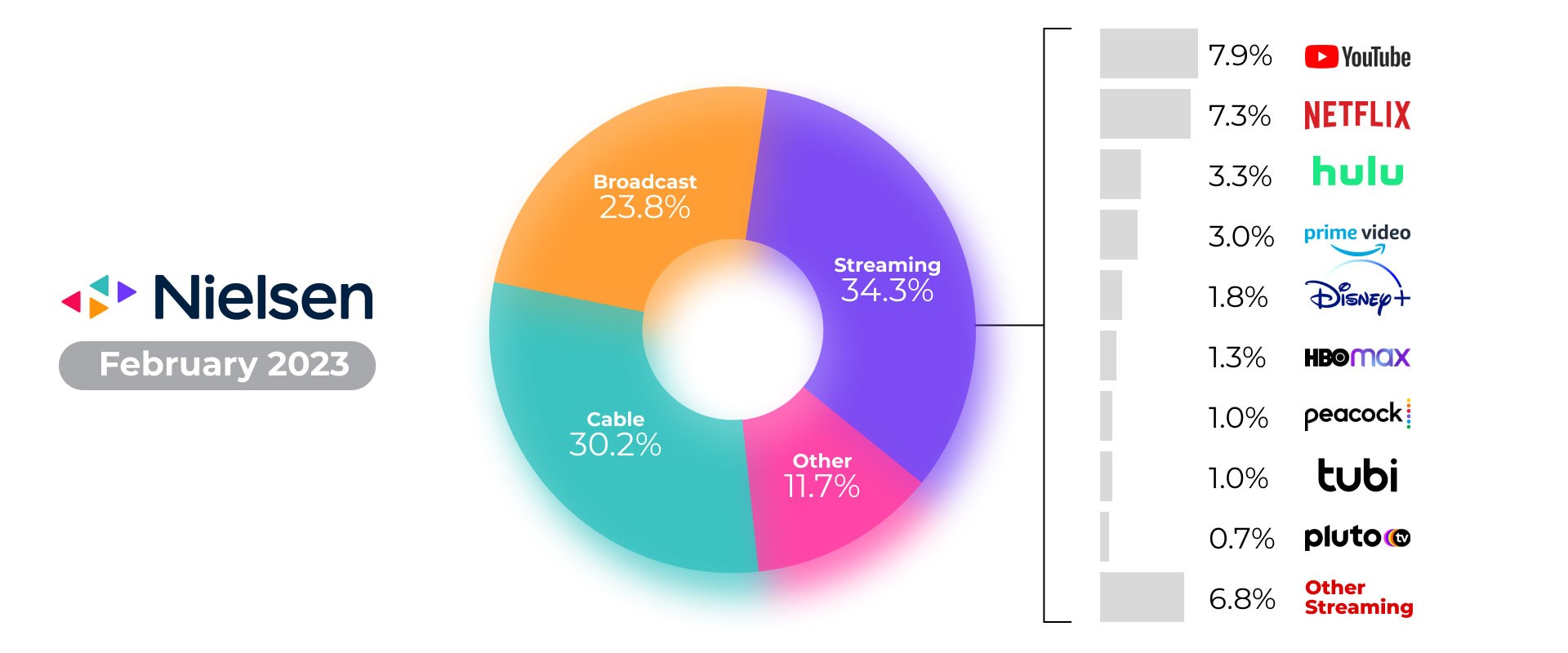

Though in 2022, the total TV advertising spend was around $88 billion, with around $69B (78%) and $19B (22%) shared by linear and streaming TV, it seems that viewers would prefer streaming TV.

Source: Nielsen The Gauge

At the same time, streaming’s share of the total TV ad budget, as TVREV reporters assume, will rise very rapidly over the next two years and continue to rise until 2027. Nevertheless, as some advertising agencies might feel uncertain about the popularity of streaming TV in the future, real growth is expected in 2024-2025.

In the meanwhile, the growing interest in FAST services goes along with several issues that advertisers are concerned about. Some of them highlighted by the TVREV report claim that:

- Lack of standardization leads to the ads overfrequency

- Absence of a clear context about the ad placement is a big issue

- TV data doesn’t allow for targeting individuals

- Ad measurement needs enhancing

Is contextual advertising the key response to all of these issues?

Would you like to put yourselves in the shoes of advertisers and feel their concerns about advertising on FAST TV? Stay with us and get to know how you can respond to adjust your FAST-based advertising offering in 2024-2025.

#1 Lack of standardization leads to the ads overfrequency

Why are advertisers concerned? First of all, let us throw light on how FAST inventory is sold to understand the current concerns of advertisers and viewers. Being sold on an audience or addressable basis, ads are displayed to viewers who watch TV. When it comes to how FAST inventory is sold, it’s purchased directly or via programmatic buying platforms. The difficulty is that different aggregators don’t coordinate on the inventory they sell, so the viewer may see ads several times in the same ad pod. So, what about advertisers? They may worry about being displayed in the same ad pod as their competitors.

How you can respond. Consolidation of content creators and FAST inventory aggregators may eliminate the difficulty of buying ad pods across all sellers. One of the solutions that may somehow connect all the FAST parties is so-called “single-source” apps. Still, the TVREV report predicts that the expensive maintenance of such applications could lead to merging around specific themes, for example, sci-fi movies and series or educational content.

The project as proof: AdTech marketplace for broadcasters and advertisers

Our client challenged Oxagile’s team to create an end-to-end AdTech marketplace platform that would connect broadcasters and advertisers in one place. Thanks to automated TV inventory selling, our client established seamless ad inventory management, including advertising offering generation, order processing, and ad campaign performance monitoring.

#2 Absence of a clear context about the ad placement is a big issue

Why are advertisers concerned? In contrast to linear TV, where advertisers are aware exactly of the position within the ad pod and time when it’s displayed, FAST platforms don’t provide such details. They may only know that the ad “ran last month or two days ago”, but the context of when and where really matters for reaching the target audience. Still, FAST platforms have no capabilities for such a precision, creating a barrier between FAST inventory sellers and advertisers, while the latter got used to receiving transparent reports when dealing with linear TV.

How you can respond. Providing insights into the genres and channels where ads run is the first step to increasing the transparency of FAST services. Some of the publishers have already satisfied this market demand, reporting about the apps the clients’ ads run on or genres they are displayed within, along with the channel list applied to those genres. Still, there’s a more technical reason for the lack of transparency, rather than the unwillingness of publishers to provide the information, and it’s the absence of universal metadata forms. Fortunately, the increasing usage of content ID makes it easier for publishers to arrange the video-related data in a unified form, as well as to target and report on the type of content the ad is run on.

#3 TV data doesn’t allow for targeting individuals

Why are advertisers concerned? Since TV data is tracked as a household activity, it’s challenging for brands to identify which individuals from the household fall into the target audience. The current situation is getting more complicated due to the inaccuracy of the data. This happens as such data hasn’t been collected, and both brands and programmers have never gathered it and are still working out the way they could do it. This creates a need for a different type of data required for brands to target individual TV viewers. Currently, advertisers need to understand that they have to target that broader audience. That might not be an issue for big brands using TV advertising to burnish their brand awareness. Though the situation is not destructive, the household resolution remains an up-to-date question.

How you can respond. The new technology of identity resolution is required, and it’s now handled via “clean rooms” used to anonymously match the data about the advertiser’s potential buyers and viewers in the programmer’s data set. There are also other solutions proposed such as universal IDs or virtual IDs based on the probalistic data. Still, it would take some time for AdTech market players to polish the approach and provide the efficient technology solution.

How we can help

Willing to find a solution to ensure FAST audience is targeted more precisely? Let’s discuss it!

#4 Ad measurement needs enhancing

Why are advertisers concerned? Most brands believe that ad measurement should be separated from programming measurement. For advertisers, the number of people watching the show is not so valuable as the number of people who watched the show with their ads. This actually creates the demad for more precise ad measurement tools separated from program measurement of video content sold for advertising.

How you can respond. Advertisers often use demand-side platforms and supply-side platforms that keep track of the ads they’ve served. In their turn, DSPs or SSPs could collaborate with companies using ACR (automatic content recognition from smart TVs) data from LG TVs, to confirm the number of households that saw the ads. Another valuable metric for advertisers could be the information about how the viewers watched the ad. There’s currently one change that’s happening: the separation of ad measurement is taking place.

As you can see, contextual advertising doesn’t directly solve all the problems, but it lies as the basic technology for driving FAST advertising to the next level.

Challenge accepted: Oxagile’s experts about contextual targeting

Q: What are the challenges Oxagile typically tackles when dealing with contextual advertising?

A: For about 20 years in the video domain, we’ve understood that AdTech platforms helping the monetization of video content are integral to this industry. In cooperation with our clients, we customize AdTech solutions with ad targeting features. To enable contextual advertising across FAST and AVOD TV services, we build solutions that allow publishers to create an ID for every video content item that is used for placing ads. Each challenge is client-specific, but some of them include:

- Audience identity attribution and management

- Content analysis and context identification

- Scene-based ad insertion such as SSAI (or DAI)

- Ads placement and optimization

Q: Why is there a demand for better contextual data on streaming?

A: It all depends on human nature, we are sometimes “too lazy” or don’t want to spend time on some things, especially on deciding what film or series to watch. Sometimes we just want to get the food to our sofa and someone to tell us what to enjoy today. And lucky the advertisers are! At least, they can leverage the viewers’ content preferences and target the right households and their individuals.

Using our cross-domain knowledge around big data, business intelligence, and machine learning, we create custom audience targeting platforms from scratch or enhance the existing solutions. We apply advanced mechanisms to gather data across multiple online sources and build comprehensive data processing systems. Based on such parameters as age, geography, preferences, browsing history, location, the data is converted into real-time user behavior patterns. Then, they serve as the basis for personalized ads.

How we can help

We’ll serve as a reliable partner to build technology solutions for advertising on FAST channels, be they convergent ad sales platforms, contextual and audience data analytics, and others.

Wrapping up

FAST services are on the rise as households are getting to prefer online streaming TV to cable TV. As a result, advertisers have to buy FAST ad pods to increase the audience coverage and not to lose those that move to streaming TV. Not sure how to get the ball rolling? Why not address it to Oxagile? Let’s talk!