CTV is taking over — and fast

Streaming isn’t just a trend anymore — it’s become the default way people watch. Connected TV (CTV), which blends traditional viewing with the flexibility of the internet, is steadily replacing old-school linear television for millions of Americans.

Let’s talk numbers. As of 2023, 88% of U.S. households had at least one internet-enabled TV device — a figure that shows just how deeply CTV is woven into everyday life1. And this isn’t slowing down. In 2022, 111 million households were using CTVs every month, with projections pointing to 121 million by 20272.

This shift isn’t just changing how people watch — it’s transforming how brands advertise. In 2023, CTV ad spending in the U.S. hit nearly $25 billion, and if forecasts hold true, that number is expected to surpass $40 billion by 20273.

This evolution is reshaping the ad world. In this piece, we’ll unpack how CTV compares with linear TV, what makes their metrics so different, and how marketers can better understand campaign performance in a connected landscape.

What is CTV?

As of 2025, Connected TV (CTV) refers to any television set that is connected to the internet and supports the streaming of video content. This includes not only external devices like gaming consoles (e.g., Xbox or PlayStation) and streaming sticks (such as Roku or Amazon Fire TV), but also Smart TVs, which come with built-in internet capabilities. For example, a Smart TV by Samsung allows you to surf the net without the need for auxiliary connectivity devices. This solution appears to make life a lot easier, creating a new space for opportunities.

A key element in this ecosystem is OTT (Over-the-Top), which delivers video content via the internet without requiring a traditional cable or satellite subscription. Major platforms like Netflix, Max (formerly HBO Max), and Disney+ are well-known examples of OTT services. While often mentioned together, OTT and CTV are distinct: OTT refers to the service delivering the content, while CTV refers to the device used to access it.

Both CTV and OTT play a major role in shaping modern viewing habits. They enable highly personalized content experiences driven by user preferences, watch history, and account-based behavior. This stands in contrast to linear TV, which relies on fixed programming schedules and broad geographic targeting. For instance, while a streaming platform might recommend a foreign-language film based on your interests, linear TV would typically only broadcast content suited to the general local audience.

What is linear TV advertising?

Broadly speaking, linear TV advertising refers to the traditional format of cable or broadcast television, which is steadily losing ground to digital alternatives. In this model, viewers have no control over what content airs — each channel follows a fixed broadcasting schedule that includes pre-planned ad slots. As a result, audiences cannot skip or rewind the content or commercials until the scheduled program ends.

At first glance, this might suggest guaranteed exposure, with one hundred percent viewability of ads. However, in practice, this is rarely the case. Just because a television is on doesn’t mean it’s being actively watched. This is one of the key limitations of linear TV measurement, which often fails to reflect actual audience engagement.

That said, programmatic advertising in linear TV is evolving to bring more precision to this space. While still developing, these advancements offer potential for smarter targeting and performance tracking — giving linear TV some staying power, even in a digital-first world.

CTV ad measurement

It is vital to know not only the number of ad impressions, but also how customers act after browsing the content. This includes assessing viewer attention, time spent with the ad, and what actions follow, such as clicks, app installs, or purchases.

Moreover, cross-platform measurement is becoming increasingly important, as advertisers seek to understand how CTV ads perform alongside campaigns on mobile, desktop, and traditional TV.

Big data processing must also be connected to succeed. After all, big data is the key to personalizing content for customers. Today, AI and machine learning play a major role in processing this data, helping optimize ad delivery and forecast viewer behavior in real time.

At the same time, stricter privacy regulations demand privacy-first solutions, making it essential for advertisers to balance personalization with compliance. Considering everything mentioned, maximizing the use of extended television advertising can be a real challenge.

Oxagile is a reliable partner for video content owners and distributors in overcoming AdTech challenges. The company is a true expert in a wide range of AdTech services, including connected and addressable TV advertising, programmatic advertising, linear TV measurement, digital outdoor advertising, OTT monetization solution development, digital out-of-home adverts, and much more. Oxagile can become your assistant in navigating the dynamic landscape of advertising technology.

Discover how to strengthen your promotional offer

Have you checked out the Oxagile OTT advertising bespoke solution? Despite the high rate of growth in popularity, CTV measurement also has its fair share of hurdles when it comes to gathering information. We’ll make them all clear to you.

Benefits of CTV measurement

CTV advertising measurement offers many advantages for companies. First is the reach of an audience that has given up on linear television. And the percentage of such customers is increasing every year. After all, CTV is gaining popularity in seven-dimensional steps.

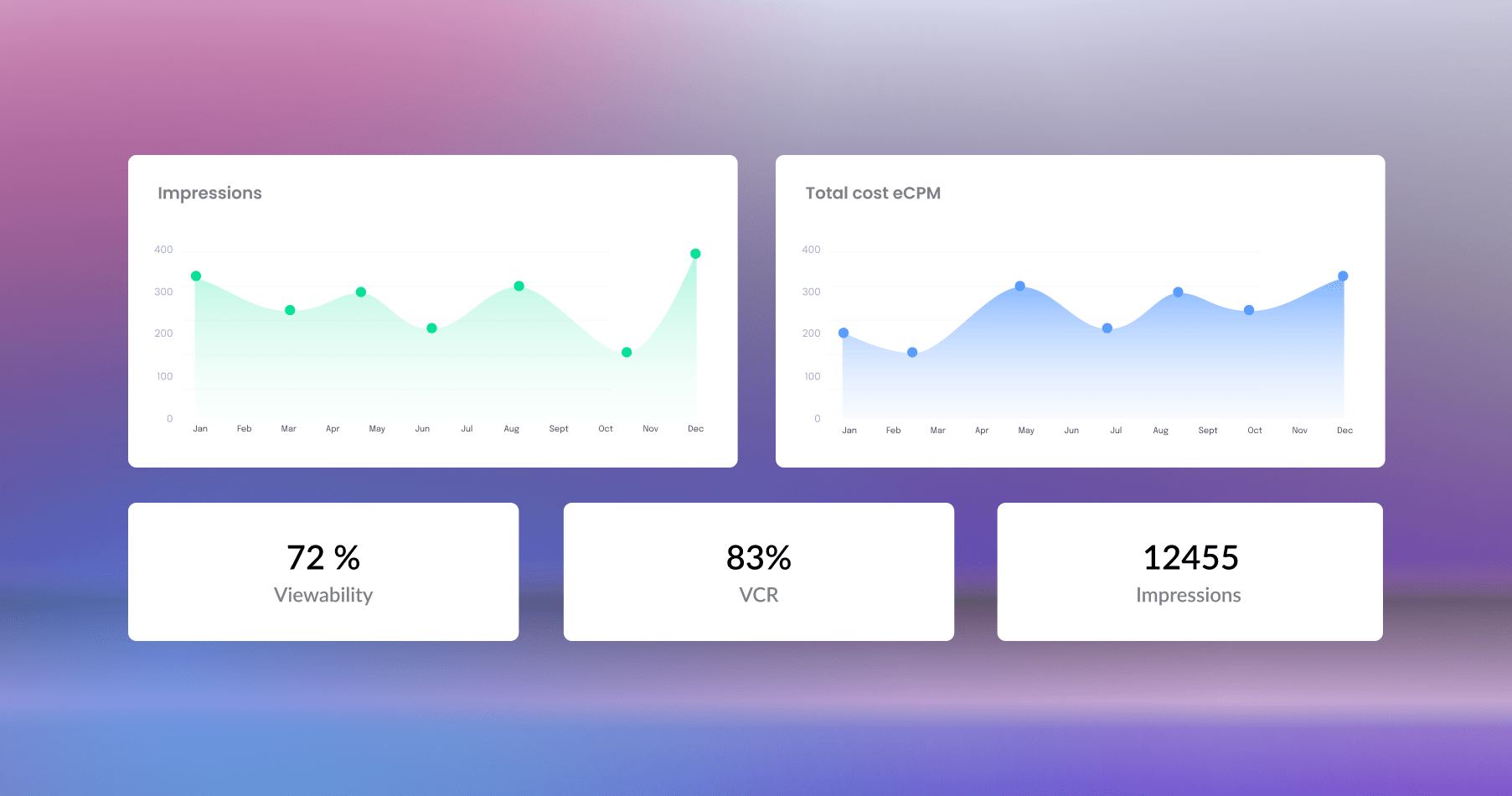

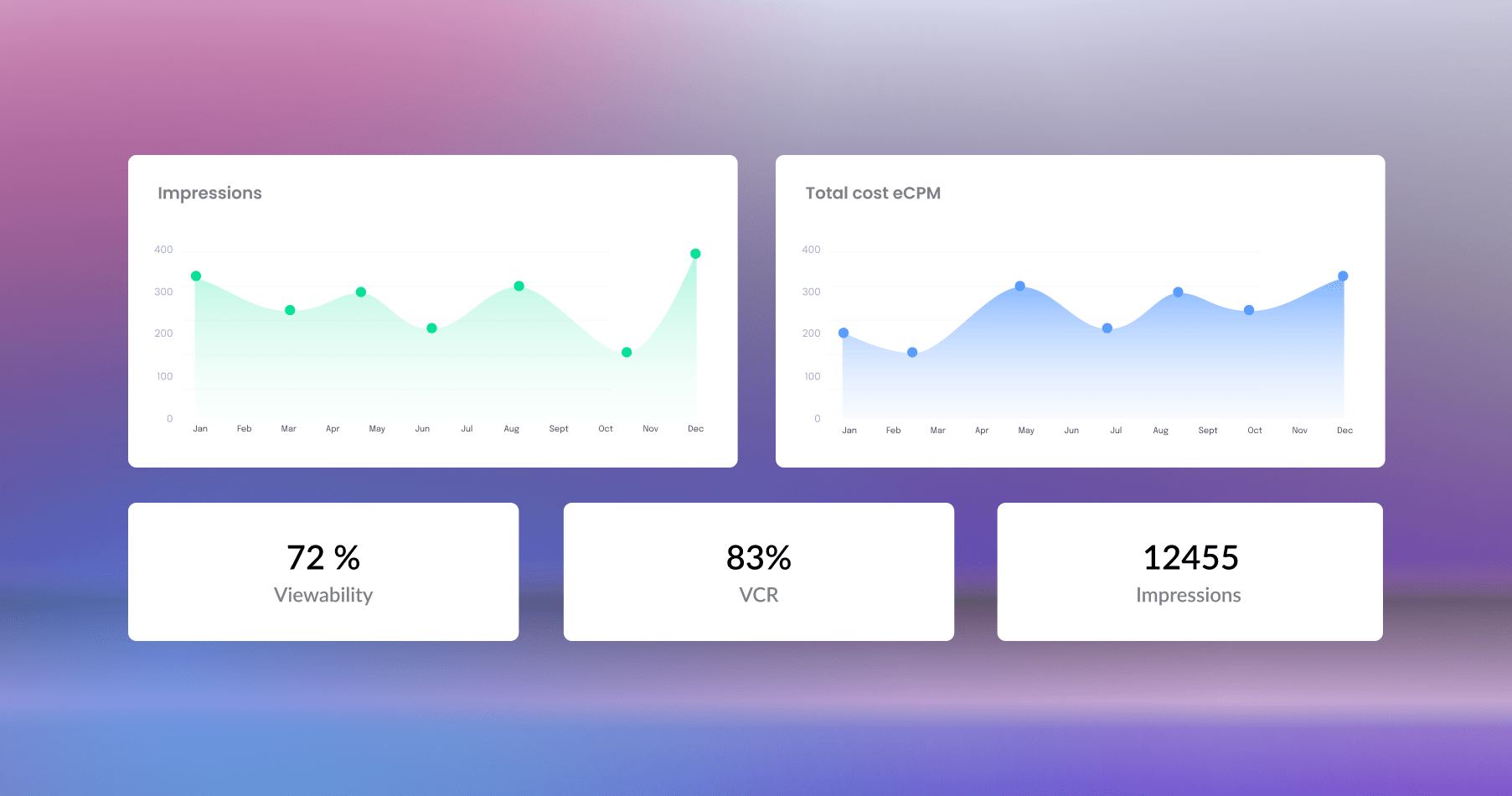

A further advantage of CTV measurement is the opportunity to get a client’s opinion. Customers’ actions after watching your ads, the number of views, impressions of your brand — all of this is available through Connected TV measurement. In addition, advertisers can access real-time analytics, allowing them to adjust campaigns on the go based on viewer engagement and behavior.

CTV also enables detailed audience segmentation and targeting, helping brands deliver more relevant and personalized advertising experiences.

While linear TV can only provide an approximate customer perception, CTV measurement indicates a more detailed picture of an advertising campaign. It can also track user journeys across devices, offering cross-platform attribution and a clearer view of campaign impact throughout the funnel. So, using this method of broadcasting content, the marketing campaign performance can be analyzed in more detail. Beyond views and impressions, advertisers can measure attention time, ad completion rates, and even conversions, making CTV a powerful performance-driven tool.

Challenges of CTV measurement

CTV attribution is a complex process, primarily due to the lack of uniform standards. There are no cross-platform indicators in the CTV advertising space, making it challenging to capture viewer audiences. Moreover, to correctly size the number of spectators, it is necessary to be skilled in handling big data.

The next difficulty will be the complexity of identifying the user. The CTV measurement platforms rely on IP addresses, which makes counting tricky. After all, one or more people can see an advertisement from the same address. There is also a separate issue if the same user is viewing ads on different devices.

Many people always switch between linear and Connected TV. As different kinds of television do not exchange data, this creates a measurement problem, too.

And there is also the challenge of dishonest advertising. Indeed, it is much easier to fake a commercial for CTV than it is for linear TV or a mobile app.

Best approaches to measure CTV

Measuring the success of advertising with a single indicator is impossible. Several approaches need to be used to assess the whole picture of the campaign’s progress. In 2025, advertisers increasingly rely on AI-powered tools to analyze audience behavior, predict outcomes, and improve decision-making in real time.

A hybrid approach to multi-channel attribution

This approach means the need to measure users and their interaction with advertising in a hybrid way.

Combinations of signals such as people counters and Automatic Content Recognition Techniques eliminate duplicate content.

It often involves using both deterministic and probabilistic methods to connect viewership data across multiple devices and platforms.

Cross-device identity resolution is also crucial for tracking users who move between smart TVs, smartphones, tablets, and desktops.

Select the best approach

Accurately measuring the audience of CTV advertising is quite complicated. But selecting the best approach is possible.

There are two possible solutions:

- pixel technology to record the display, start and end of video, and to detect invalid traffic;

- SDK for multi-channel recording.

Additionally, attention-based metrics such as viewability, time spent watching, and ad completion rates are now used to better understand real engagement.

Making a proper report

Make sure that the content displayed is effective by checking the activity of the advertisement. For example, exclude the display of CTV advertisements when the device is switched off.

Incrementality testing can also be conducted to measure the true impact of your campaign by comparing exposed and control audience groups.

Brand promotion tracking

Evaluate the impact of CTV advertising on brand perception. Combine customer surveys with behavioral data to measure brand lift and overall campaign success.

Linear TV advertising measurement

Just like Connected TV, linear TV measurement has its strengths and weaknesses. In many issues, linear tv is no less powerful than the innovator of streaming TV.

However, this approach is extremely effective paired with Connected TV, which we have already understood. So, let’s break it down.

Benefits of linear TV measurement

Ad campaigns can be launched to coincide with particular events through linear television, for instance, a commercial before a sporting event or a specific event. Timed campaigns are often highly effective, generating positive customer attitudes.

Also, most older people prefer linear television. Do not forget about this segment of the population, because it also accounts for a sizable percentage. The older generation is renowned for its gullibility to ads, which means they are more reactive to such content than anyone else.

Particularly relevant is the fact that linear television is strictly segmented following the topic of the channel. This enables us to carefully select the right channel for effective linear TV advertising, as well as the time of the demonstration. By selecting the exact time, it is easy to find the period in which the advertisement will be seen by a larger number of users.

Challenges of linear TV measurement

Regarding the drawbacks of linear TV measurement, the main ones are the extensive targeting and the lack of accuracy common to CTV and OTT. In fact, just because the television is on, it doesn’t mean it is being watched. A person may fall asleep, be distracted, and not see the linear TV advertising.

As far as targeting is concerned, it cannot be precise enough, even when considering the subject matter of the channel. After all, linear television does not collect any user info.

Approaches to measuring linear TV

The linear TV measurement is not standing still. Already today, companies are presenting a novel way of looking at linear tv advertising measurement. Let’s explore the list of firms proposing to change the way we look at linear TV measurement.

VideoAmp

VideoAmp has positioned itself as a major player in the shift toward cross-platform measurement, offering tools that unify data from linear TV, CTV, digital, and walled gardens. In 2025, it continues gaining traction among agencies and advertisers as an alternative to traditional providers like Nielsen.

Notable for: Unified audiences, custom attribution models, clean room integrations.

Comscore

While not new, Comscore has significantly expanded its TV measurement tools by 2025, especially for local and national linear TV. It uses data from millions of smart TVs and set-top boxes, integrating with digital platforms to provide a deduplicated, cross-platform view.

Notable for: Large passive TV data sets, political campaign measurement, deduplicated reach.

605

605 offers data-driven TV analytics that combine return path data from set-top boxes with advanced attribution modeling. It’s been increasingly mentioned in the linear TV attribution space in 2024–2025 for its work with MVPDs and advertisers seeking deeper insights into viewer behavior.

Notable for: Attribution modeling, audience segmentation, custom reporting for linear.

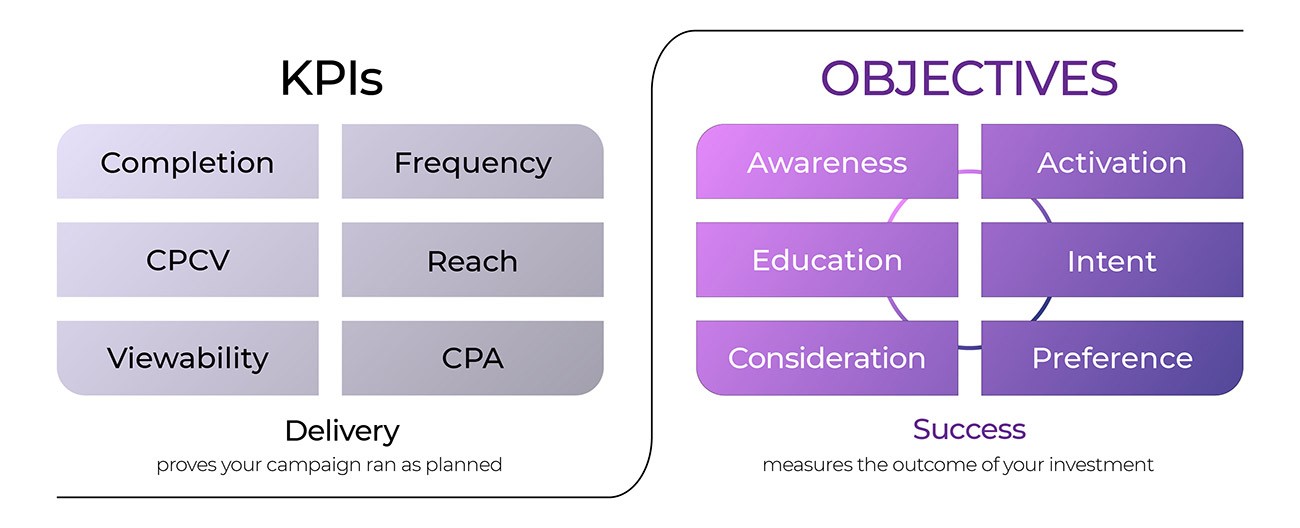

How to measure the success of TV advertising?

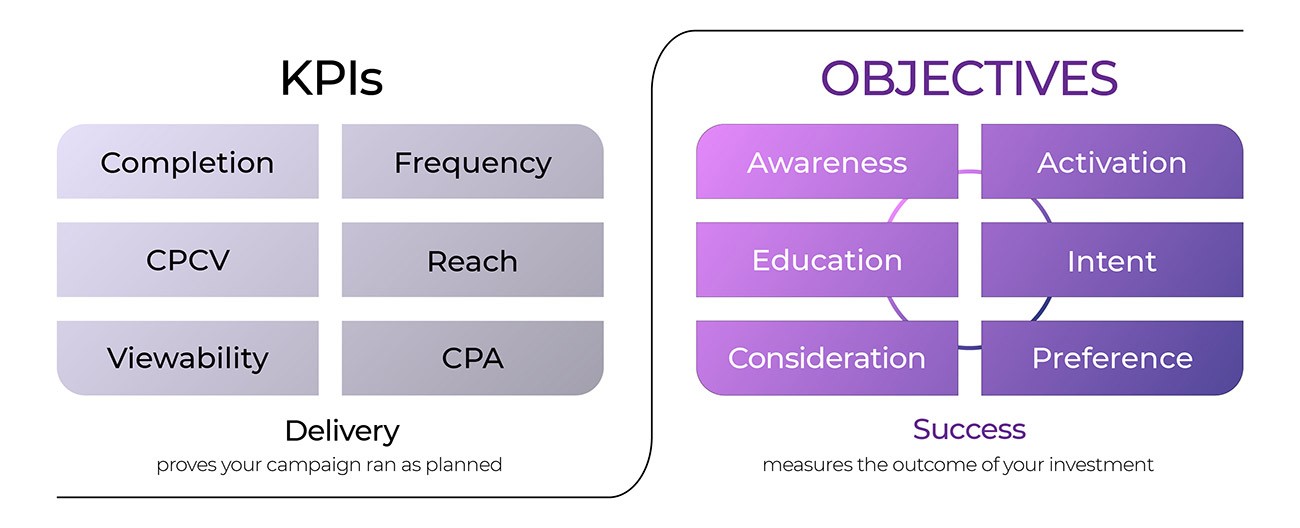

Choosing the right platform for a given aim is extremely important. But it is also vital to be able to determine the effectiveness of the advertisement. When it comes to evaluating the impact of various ad campaigns, there are a bunch of metrics to consider.

The performance metrics may differ by geography, industry, distribution channel, type of device, and type of media buying. However, it is worth noting that only one of these is not enough for a meaningful evaluation.

Typical metrics: What are they?

- Video completion rate. The VCR metric is a priority, especially if the target of your advertising is to lift the brand. It shows how many times the ad has been viewed until the end. In this way, you can gain information about people’s interest and involvement in the advertisement.

- Ad completion rate by quartile. This metric reveals how many viewers watch 25%, 50%, 75%, or 100% of the ad — helping identify when engagement drops off.

- Reach. This metric is responsible for the number of unique ad viewers. The indicator is extremely useful in evaluating the success of the campaign, the budgetary costs, and the right choice of platform.

- Frequency. Shows how many times a unique viewer has seen the ad. Helps avoid underexposure or ad fatigue.

- Attention metrics. These go a step beyond viewability, measuring how long users actively engage with the ad — including whether the screen is in focus or the user is looking at it.

- Engagement rate. If the ad includes interactive elements (such as clickable content or remote-control actions), this metric shows how often users interact with it.

- Viewability score. The visibility indicator provides a measure of the format in which it is better to show ads. Usually, the visibility score is based on the viewing time and the percentage displayed on the phone, computer, or TV screen.

- Audible score. Another indicator is for the number of shows on which the advertisement was heard.

- Attribution tracking. Attribution is linked to the relationship between the investment in the campaign and the customers’ expected actions (clicking on the company’s website, buying the company’s products, etc.).

- Incrementality. This measures how much of the outcome (e.g. conversions) was directly caused by the ad, by comparing exposed and non-exposed groups.

- Cost per thousand views. Refers to the cost of thousands of views, regardless of uniqueness or visibility.

- Cost per completed view. The ratio between the cost of an advertising campaign and the number of completed (full) views.

- Return on ad spend. The aim is to estimate the profit generated from the ad compared to the money spent on it.

- View-through conversions. This metric is born to trace the number of viewers taking action (e.g., closing the purchase) after seeing the ad.

- Brand lift studies. By combining survey results and behavioral data, these studies measure changes in awareness, favorability, or purchase intent after ad exposure.

CTV vs. Linear TV: The conclusion

CTV and linear TV represent two fundamentally different advertising ecosystems — each with its own strengths, limitations, and ideal use cases. A successful marketing strategy in 2025 isn’t about choosing one over the other, but about learning how to combine them effectively.

CTV offers precision targeting, real-time analytics, and performance metrics that go far beyond what linear TV can deliver. At the same time, linear TV still holds massive value for broad reach, brand awareness, and cultural relevance — especially for live events and large-scale national campaigns.

By repurposing linear TV creative for CTV and refining delivery through personalized targeting, advertisers can significantly expand their reach and relevance. CTV doesn’t replace linear — it extends it, reinforcing messaging and increasing brand recall among digitally engaged audiences.

Blending both formats allows for smarter budget allocation, diversified ad placements, and a richer understanding of viewer behavior. With tools now available for unified measurement, attribution, and campaign optimization, marketers can finally analyze and act on data across platforms — no longer treating linear and CTV as isolated silos.

Ultimately, leveraging the complementary power of both approaches will be key to achieving consistent, scalable, and measurable results in the evolving media landscape.

Any lingering questions left? We are here to help

The world of CTV and addressable TV, as well as of Linear TV, is full of exciting opportunities beyond just ad measurements. If there are any confusing aspects that you need help understanding, our AdTech experts are always at your disposal.

Sources:

1. Statista: Connected TV penetration rate in the U.S.

2. Statista: Number of connected TV households in the U.S.

3. Statista: Connected TV advertising spending in the U.S.